ICAS Maritime Affairs Handbill (online ISSN 2837-3901, print ISSN 2837-3871) is published the last Tuesday of the month throughout the year at 1919 M St NW, Suite 310, Washington, DC 20036.

The online version of ICAS Maritime Affairs Handbill can be found at chinaus-icas.org/icas-maritime-affairs-program/map-handbill/.

“Norway and Vietnam Strengthen Partnership on Sustainable Ocean Governance”

April 26 – ScamdAsoa

[Norway, Vietnam]

The Norwegian Embassy in Hanoi organized a webinar to deepen cooperation between Norway and Vietnam in the fields of marine spatial planning, ocean governance, and sustainable development. Norway reaffirmed its commitment to continue close collaboration with Vietnamese authorities and partners to help deliver strong, smart, and impactful outcomes.

“China And Indonesia Agree To Boost Maritime Security Cooperation In South China Sea Despite Tensions”

April 21 – Huron Daily Tribune

[South China Sea, China, Indonesia]

China and Indonesia have agreed to boost maritime cooperation, focusing on security and stability in the South China Sea. The agreement was reached during high-level diplomatic talks in Beijing, emphasizing regional safety amid ongoing geopolitical tensions.

“China Joins Treaty to Fight Illegal Fishing, a Major Milestone for Ocean Governance”

April 17 – Pew Trust Foundation

[China]

In a major milestone in the global fight against illegal, unreported and unregulated (IUU) fishing, China – which has the world’s largest fishing fleets – joined the Port State Measures Agreement to ensure that only legally caught fish move through the world’s ports.

“MAHASAGAR Is The Next Step In India-Africa Collaboration. It Addresses Maritime Security”

April 9 – The Print

[Tanzania, Kenya, Madagascar, Mauritius, Seychelles, South Africa, Indian Ocean]

Washington Maritime Blue’s Sustainable Maritime Fuels Collaborative aims to accelerate clean fuel adoption in the Pacific Northwest maritime industry, reducing emissions and promoting environmental justice. India’s MAHASAGAR vision focuses on maritime security and collaboration with African nations through joint initiatives like naval exercises and the Indian Ocean Ship SAGAR mission.

“India, Sri Lanka Ink 10 Agreements Including In Defence, Power, Energy”

April 5 – Hindustan Times

[Sri Lanka, United Arab Emirates, India]

India and Sri Lanka have signed 10 agreements to strengthen collaboration in defense, energy, and digital initiatives, including the development of Trincomalee as an energy hub. These agreements highlight India’s support for Sri Lanka’s economic recovery and efforts to bolster bilateral ties.

“UK And Mauritius Close In On Deal Over Chagos Islands After Us Signals Its Consent”

April 1 – ABC News

[ U.K., Mauritius, U.S.]

The UK and Mauritius are nearing an agreement over the sovereignty of the Chagos Islands, with provisions to lease the Diego Garcia military base back to the UK for 99 years. The United States has shown support for the deal, given its strategic interest in the base.

“White House Could Bypass UN on Deep-Sea Mining”

March 31 – Marine Link

[ U.S., ISA]

The U.S. White House is considering bypassing the United Nations-backed International Seabed Authority to expedite permits for deep-sea mining, aiming to access critical minerals like nickel and copper. This decision raises environmental concerns and could provoke international disputes over the governance of ocean resources.

“Navy Cancels 56-Year-Old International Seapower Symposium Due to ‘Unavailable Funding’”

April 22 – USNI News

[U.S.]

The U.S. Navy is canceling its biennial International Seapower Symposium due to “unavailable funding,” the service confirmed to USNI News Thursday. The chief of naval operations has hosted the heads of more than a hundred navies every other year at the Naval War College in Newport, R.I., for the three-day long symposium since 1969.

“U.K. Carrier HMS Prince of Wales Leaves for 8-month Pacific Deployment”

April 22 –USNI News

[U.K., Norway, Canada, Spain]

The U.K. aircraft carrier HMS Prince of Wales has departed on an eight-month Pacific deployment, conducting joint exercises with allied nations like Japan and Australia. This mission, Operation Highmast, reinforces the U.K.’s commitment to international security.

“Sri Lanka’s Defense Agreement With India And The Prospects For Peace In The Indian Ocean”

April 9 – Peoples Dispatch

[Sri Lanka, India, Indian Ocean]

Sri Lanka and India have signed a defense cooperation agreement to enhance military collaboration and security efforts in the Indian Ocean region. This agreement, exchanged during Indian Prime Minister Narendra Modi’s visit to Sri Lanka

“Acting CNO Reveals Fleets’ Surge Readiness At Around 68 Percent Amid Quest For 80”

April 8 –Breaking Defense

[U.S., China]

The U.S. Navy’s current surge readiness level stands at approximately 68 percent, with a target to reach 80 percent combat readiness by 2027. This effort, led by Acting Chief of Naval Operations Adm. James Kilby, comes amid growing global military demands and potential Indo-Pacific conflicts.

“Satellite Images Show Multiple US B-2 Nuclear-Capable Bombers Deployed To Indian Ocean”

April 3 – Abc News

[U.S., Diego Garcia, Indian Ocean, Iran, Yemen]

Satellite imagery shows the deployment of U.S. B-2 nuclear-capable bombers to Diego Garcia, reinforcing the Pentagon’s strategic position in the Indian Ocean. This move is a response to escalating threats from Iran and Yemen’s Houthi rebels, emphasizing heightened military readiness.

“As Iran Tensions Build, Us Military Moves Warplanes To Reinforce Middle East”

April 1 – Reuters

[Iran, U.S., Yemen, Indian Ocean]

The U.S. is increasing its military presence in the Middle East, deploying advanced aircraft and missile defense systems amid rising tensions with Iran and threats from Yemen’s Houthi rebels. Diego Garcia, a key U.S.-British base, is playing a strategic role in these efforts.

“Aussie Spy Planes Worked Overtime During Nearby Chinese Naval Drills”

March 28 – DefenseNews

[Australia, New Zealand, China]

Australia and New Zealand deployed surveillance aircraft to monitor Chinese naval drills, including live-fire exercises in the Tasman Sea. The presence of three Chinese warships near their coasts has heightened regional security concerns in the Indo-Pacific.

“Terradepth to Showcase Enhanced Absolute Ocean Capabilities at Sea-Air-Space 2025”

March 27 – Businesswire

[U.S.]

Terradepth is showcasing its upgraded Absolute Ocean platform at the Sea-Air-Space 2025 exposition, featuring tools for real-time collaboration and advanced object identification. These enhancements aim to improve maritime domain awareness and bolster defense operations globally.

“Russia Flexes Missile Muscles at US Ally”

March 27 – Newsweek

[Russia, Japan, Sea of Japan]

Russia’s Pacific Fleet submarine Ufa carried out missile exercises in the Sea of Japan, using Kalibr cruise missiles to hit naval and coastal targets. The drills underscore Russia’s strategic military activities in a region close to Japan and the broader Indo-Pacific.

“Syria Receives First Wheat Shipment Of 6,600 Tonnes After Assad’s Fall”

April 21 – Marine Insight

[Syria, Russia, Ukraine, Turkey]

Syria has received a 6,600-tonne wheat shipment at the Port of Latakia, marking a significant step in its post-Assad recovery. Reports suggest the shipment originated from Russia, though officials have yet to confirm the source.

“US Extends Port Ban On Russian Ships As War In Ukraine Continues”

April 18 – Marine Insight

[U.S., Russia, Ukraine]

The U.S. has extended its ban on Russian ships docking at American ports for another year, continuing sanctions aimed at pressuring Moscow over the war in Ukraine. The restrictions, alongside efforts to target Russia’s shadow fleet of aging oil tankers, remain in place until a ceasefire is reached.

“US Snubs Key Shipbuilding Summit As Global Maritime Rift Deepens”

April 10 – South China Morning Post

[U.S., China, Japan, South Korea]

The U.S. has declined to participate in a major global shipbuilding summit, highlighting growing tensions in the maritime sector. This decision underscores efforts to counter China’s influence in shipbuilding and broader industry competition involving nations like Japan and South Korea.

“US Government Investigates Strategic Importance of Northern Sea Route as Part of Study on Maritime Chokepoints”

April 9 – High North News

[U.S., Russia, China, Northern Sea Route, Arctic]

The U.S. is examining the Northern Sea Route’s strategic significance amid the opening of Arctic waterways due to melting ice. This study highlights the route’s potential to impact global trade and competition with Russia and China over governance and security in the region.

“Trump Orders Agencies to Chart U.S. Maritime Revival”

April 9 – The Wall Street Journal

[U.S., China]

Former President Donald Trump issued an executive order to revive the U.S. maritime sector by strengthening domestic shipbuilding and expanding the U.S.-flagged fleet. The plan also includes developing a security strategy for Arctic trade routes and addressing China’s dominance in global shipbuilding.

“US Exits Carbon Talks On Shipping, Urges Others To Follow, Document Says”

April 9 – Reuters

[U.S., Brazil, China, Saudi Arabia, South Africa]

The United States has exited international talks on shipping decarbonization, citing concerns over economic burdens and inflation. This decision has intensified debates involving nations like China, Brazil, Saudi Arabia, and South Africa over the global trade impacts of proposed carbon measures.

“Business Oyetola Leads The Way For Shipping Decarbonisation In Africa”

April 7 – Nigerian Tribune Online

[Nigeria]

Nigeria’s Minister of Marine and Blue Economy, Adegboyega Oyetola, is championing efforts to make Africa a global leader in shipping decarbonization. At the African Strategic Summit on Shipping Decarbonisation, he highlighted the continent’s renewable energy potential and geographic advantages for transitioning to low-carbon shipping.

“Washington Maritime Blue Launches New Sustainable Maritime Fuels Collaborative”

April 4 – Chamber of Shipping

[U.S.]

Washington Maritime Blue has introduced the Sustainable Maritime Fuels Collaborative to promote the use of clean fuels in the Pacific Northwest’s maritime industry. This initiative seeks to cut greenhouse gas emissions, advance environmental justice, and sustain global competitiveness.

“Trump’s Trade Offensive Against China Hits the High Seas”

March 26 – Bloomberg

[U.S., China]

President Donald Trump’s trade policies have significantly impacted global supply chains, particularly through tariffs on Chinese ships. These measures have disrupted trade, heightened costs, and intensified competition in the maritime sector.

“Defenders Endorses Bills to Secure a Future Against Offshore Drilling”

April 22 – Defenders of Wildlife

[ U.S., Russia]

Defenders of Wildlife has endorsed legislation to prevent offshore drilling, aiming to protect marine ecosystems and coastal communities from environmental harm. These bills seek to secure a sustainable future by reducing risks associated with expanded oil and gas extraction in U.S. waters.

“As New England Waters Warm, Invasive Sea Squirts Move In”

April 22 – Wbur

[ U.S.]

Warming waters in New England have led to a surge in invasive sea squirts, which threaten local marine ecosystems and commercial fishing. Scientists attribute their rapid spread to climate change and the lack of natural predators, causing disruptions in the region’s fishing industry.

“Shipping’s Climate Deal Sets Up Battle Over Pollution Calculations For Gas And Biofuels”

April 18 – Climate Change News

[IMO, China, India, Brazil, Saudi Arabia]

The International Maritime Organization (IMO) has set a 2028 deadline for large ships to cut emissions or face financial penalties, sparking debate over pollution calculations for different fuel types. Countries like China, India, Brazil, Saudi Arabia, and the U.S. are advocating for emission standards that favor their industries in the global shipping sector.

“A New Age Of Innovative Blue Finance To Protect Southeast Asia’s Ocean”

April 15 – World Economic Forum

[Indonesia, the Philippines, Vietnam, Malaysia]

Southeast Asian nations are embracing blue finance to support marine conservation and sustainable fisheries. Despite heavy reliance on ocean resources, only 3% of national seas in the region are formally protected, prompting innovative financial strategies to boost environmental resilience.

“Major Nations Agree On First-Ever Global Fee On Greenhouse Gases With Plan That Targets Shipping”

April 11 – AP News

[India, China, E.U., Japan]

A global agreement led by the International Maritime Organization introduces a carbon levy on shipping emissions, aiming to reduce greenhouse gases and fund cleaner technologies. The deal also allocates resources to support vulnerable nations and promote sustainable maritime practices worldwide.

“US Against Plan For Levy On Carbon Emissions From Ships, Leak Suggests”

April 9 – The Guardian

[U.S., China]

The U.S. has expressed concerns that a proposed global levy on carbon emissions from ships could drive inflation and strain the economy. While aimed at reducing greenhouse gas emissions, the levy has sparked international debate, involving countries like the U.S. and China, over its potential impact on global trade and developing economies.

“NOC Launches Innovation Hub to Power Ocean Tech and Blue Economy”

April 9 – Marine Link

[NOC, U.K.]

The UK’s National Oceanography Centre (NOC) has opened an Innovation Hub in Southampton to advance ocean technology and strengthen the blue economy. The hub fosters collaboration among researchers and businesses to drive progress in marine autonomous systems, renewable energy, and sustainable maritime practices.

“The Commonwealth Unpacks Critical Negotiations For Decarbonising Global Shipping”

April 8 – The Commonwealth

[Nigeria, Belize, Australia, Canada, etc.]

The Commonwealth Secretariat has gathered experts to negotiate strategies for reducing greenhouse gas emissions in global shipping, aligning with the International Maritime Organization’s decarbonization goals. These discussions aim to address the needs of developing nations and Small Island Developing States while promoting sustainable maritime practices.

“Ireland’s ‘Blue Economy’ Making Waves In Jobs And Growth”

April 4 – Irish Examiner

[Ireland]

Ireland’s ocean economy showed resilience and growth from 2019 to 2023, reaching a turnover of €6.5bn in 2023 and supporting over 39,000 jobs. Innovations like seaweed farming are driving sustainable development, addressing climate challenges, and fostering a regenerative blue economy.

“The World Has No Rulebook For Deep-Sea Mining. One Company Is Pushing Forward Anyway”

March 27 – Utah Public Radio

[ISA, U.S., TMC]

Deep-sea mining faces growing scrutiny due to the absence of international regulations and significant environmental concerns. Nauru and The Metals Company are pushing ahead with mining plans in the Pacific Ocean, challenging global efforts to establish protective guidelines.

“If Chinese-Built Containership Fines Take Effect, ‘We’re Out Of Business In U.S.,’ Ocean Carrier Says”

March 27 – NBC Philadelphia

[China, U.S.]

Proposed U.S. government fines on Chinese-built cargo ships could force the Atlantic Container Line to exit the American market, disrupting supply chains and driving up freight costs. Critics argue the policy, aimed at boosting U.S. shipbuilding, may unintentionally harm domestic businesses while sparing the largest Chinese operators.

In March 2024, five major labor unions—including the United Steelworkers (USW)—petitioned the Biden administration to investigate what they described as China’s “unreasonable and discriminatory” practices in the maritime, logistics, and shipbuilding sectors. Shortly after that, the Office of the United States Trade Representative (USTR) launched a Section 301 investigation, concluding in January 2025 that China’s shipbuilding industry was supported by massive state subsidies, intellectual property violations, market access restrictions, and suppressed labor costs. The findings were further discussed in public hearings in March 2025, where lawmakers emphasized that Chinese dominance poses a direct threat to U.S. industrial and strategic capacity.

These new dynamics come amid an increasingly stark gap between the U.S. and China in shipbuilding industrial capacity. According to Visual Capitalist, China delivered 32.86 million gross tons (GT) of ships in 2023, while the United States produced just 60,000 GT. Clarkson Research also reported that in 2024, Chinese shipyards secured 46.45 million compensated gross tons (CGT) in new orders—71% of the global total. South Korea followed with 10.98 million CGT, while the U.S. failed to register.

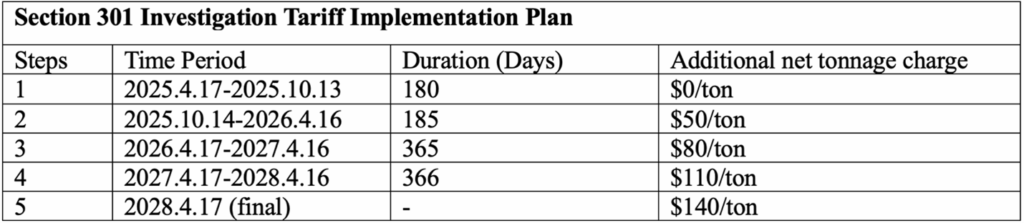

On April 17, 2025, the Office of the U.S. Trade Representative announced that, following a year-long Section 301 investigation, the U.S. would impose new port fees and tariffs on China-related vessels and port equipment. The measures represent a scaled-back version of the February 2025 proposal, which had called for fees of up to $1.5 million per port call for China-built ships.

The finalized plan will roll out in two phases, beginning with a 180-day exemption period. After that, Chinese vessel owners and operators will be charged based on a ship’s net tonnage per U.S. voyage, starting at $50 per ton and increasing by $30 annually, reaching $140 by 2028. The fee will apply at the first port of entry per rotation and be capped at five charges per year. The plan also introduces a service fee targeting foreign-built vehicle carriers, calculated by Car Equivalent Unit (CEU) and set at $150 per CEU after the grace period.

These new measures have triggered strong reactions among key stakeholders in the global shipping industry and domestic trade associations, with many warning that the proposed measures could lead to unintended economic consequences. The World Shipping Council, for example, has claimed that the fee structure unfairly targets large, efficient container ships that deliver essential goods to U.S. ports. By tying charges to vessel capacity, the policy risks raising costs for U.S. businesses and consumers while penalizing ports that have invested heavily to handle larger ships. Meanwhile, U.S. industry groups have voiced similar concerns. The American Apparel and Footwear Association, for instance, warned that forcing shippers to use American-built vessels—often five times more expensive and in short supply—would impose unnecessary costs on manufacturers and retailers.

First, while the U.S. government aims to counter China’s dominance in shipbuilding through its new port fee regime, the strong backlash it has triggered underscores the challenges of translating strategic ambition into effective industrial policy. Specifically, the U.S. government is attempting to use protectionist tools in a globalized industry where few affordable alternatives exist. Tariffs and port fees alone are unlikely to reverse decades of decline without a systematic industrial policy that supports investment in infrastructure and workforce training. Moreover, it remains unclear what strategic objective these protectionist policies aim to achieve. Without clear benchmarks for success, these measures risk becoming symbolic gestures rather than a coherent industrial strategy.

Second, the new measures targeting the global shipbuilding industry are redistributive in nature and may create new winners and losers. For China, these measures could raise operating costs and intensify competitive pressure on its shipbuilding firms in the short term, potentially weakening their global competitiveness. At the same time, the restrictions may prompt shipping companies to favor South Korean and Japanese vessels, diverting orders away from Chinese yards. However, given limited capacity, labor shortages, and rising costs in both Japan and South Korea, it remains uncertain whether their industries can fully absorb the overflow. Combined with the absence of a coherent U.S. industrial strategy, it remains difficult to predict who will ultimately emerge as the beneficiaries—or bear the costs—of this global restructuring.

This issue’s Spotlight was written by Zichong Ye, Long-term Research Assistant Intern.

Government Releases & Other Press Statements

Analyses & Opinions

Other Research

Trump’s Shipbuilding Ambition Risks Backfiring on His Big Deal

by Yilun Zhang

April 28, 2025

The Trump administration’s renewed pressure on China’s shipbuilding and maritime shipping industries offers yet another vivid testament to its enduring commitment to U.S.–China competition. These latest initiatives—confusing port fee policies with heightened national security rhetoric—reveal a trajectory where geopolitical anxieties have eclipsed economic pragmatism. Given the administration’s historical grievances toward globalization, its enthusiasm to compete with China, and its willingness to destabilize norms, such a strategy is unsurprising. Yet by heavily securitizing a once-commercial rivalry, President Trump not only unsettles the international order but also erodes the fragile foundations of U.S.–China relations. At a moment when tariffs had already driven ties to a new historic low, turning shipbuilding into a security flashpoint ensures that meaningful dialogue remains a distant prospect.…

The Black Sea Chessboard: US, Russia, and Ukraine in a High-Stakes Gambit

by Nong Hong

April 2, 2025

On March 26, 2025, the United States brokered separate agreements with Ukraine and Russia to cease maritime attacks in the Black Sea and halt assaults on energy targets. As part of the deal, the U.S. agreed to assist Russia in lifting certain sanctions related to agricultural and fertilizer exports. However, Russia has stipulated that its commitment to the maritime ceasefire is contingent upon the lifting of certain U.S. sanctions, particularly those affecting its agricultural exports and access to payment systems. Ukrainian President Zelensky, however, remains doubtful about loosening sanctions on Russia, questioning Moscow’s genuine commitment to peace…

Moratoriums vs. Mining: How ISA’s 30th Session Wrestled With Environmental Thresholds, Profit Sharing, and the Rush to Regulate

by Nong Hong

March 31, 2025

Part I of the 30th Session of the International Seabed Authority (ISA), concluded on March 28 2025, marked significant developments in the ongoing effort to establish regulations for the exploitation of mineral resources in international seabed areas. As the governing body responsible for overseeing deep-sea mining under the United Nations Convention on the Law of the Sea (UNCLOS), the ISA is tasked with balancing resource extraction, environmental protection, and the equitable sharing of benefits among nations. This session, attended by all 36 Council Members, 24 non-Council Members, and 26 observer delegations, featured critical discussions and negotiations that are shaping the future of seabed mining. However, it also highlighted the complex challenges and divergent interests among member states and other stakeholders.

The Institute for China-America Studies is an independent nonprofit, nonpartisan research organization dedicated to strengthening the understanding of U.S.-China relations through expert analysis and practical policy solutions.

1919 M St. NW Suite 310,

Washington, DC 20036

icas@chinaus-icas.org

(202) 968-0595

© 2026 INSTITUTE FOR CHINA-AMERICA STUDIES. ALL RIGHTS RESERVED.