ICAS Bulletin (online ISSN 2836-3418, print ISSN 2836-340X) is published every other week throughout the year at 1919 M St NW, Suite 310, Washington, DC 20036.

The online version of ICAS Bulletin can be found at chinaus-icas.org/bulletins/.

– China reduced its U.S. Treasury holdings in March by $18.9 billion, dropping to the third-largest foreign holder as Britain took second place, amid Beijing’s push to diversify reserves and rising trade tensions with Washington.

– Moody’s downgraded the U.S. credit rating from Aaa to Aa1 due to rising debt and interest costs, triggering market jitters and highlighting growing fiscal concerns amid Trump’s stalled tax bill and deepening partisan gridlock.

– U.S. companies are rushing to ship goods from China during a 90-day tariff pause, causing a nearly 300% spike in freight bookings and raising concerns about upcoming supply chain bottlenecks and shipping shortages.

– On May 15, former U.S. Senator David Perdue officially began his role as U.S. Ambassador to China in Beijing amid escalating U.S.-China tensions over tariffs, vowing to strengthen American interests, while China pledged to support his diplomatic mission.

– China has paused export restrictions on 28 U.S. companies and eased other trade curbs, but maintained its ban on exporting seven key rare earth metals to the U.S.

– A day after the “truce,” Chinese President Xi Jinping issued a veiled rebuke of the U.S., warning that “bullying and hegemonism only lead to self-isolation.”.

– On May 12, the United States and China reached a surprise agreement to drastically roll back tariffs for 90 days, reducing tariff from 145% to 30% (20% based on fentanyl issue) and marking a major breakthrough in their long-running trade war and boosting global markets.

– Just ahead of trade talks with the U.S., China pledged to intensify enforcement of export controls on critical minerals, which the US remains heavily dependent on Chinese supplies despite efforts to diversify.

Associated News Sources:

“China cuts US Treasury stockpile, dropping to No 3 spot among foreign holders,” The South China Morning Post, May 17

“Instant View: With Moody’s Downgrade, U.S. Loses Treasured Aaa Credit Rating,” US News, May 16

“U.S. companies surge shipments from China following tariff pause,” NBC News, May 16

“New U.S. Ambassador To China David Perdue Takes Up Beijing Post,” Forbes, May 15

“China keeps hold on rare earth metals after lifting some U.S. export curbs,” CNBC, May 15

“Bullying only leads to self-isolation, Xi says day after US-China tariff truce,” CNN Business, May 13

“US and China agree to drastically roll back tariffs in major trade breakthrough,” CNN Business, May 12

“China to Crack Down on Rare-Earth Materials Ahead of U.S. Trade Talks,” The Wall Street Journal, May 9

“U.S. and Chinese officials will meet in Geneva in the first sign of thaw in trade war,” NPR, May 7

– On May 18, China imposed anti-dumping duties of up to 74.9% on POM copolymer imports from the US, EU, Japan, and Taiwan, citing unfair trade practices following a year-long investigation launched after heightened US tariffs on Chinese goods.

– Despite pressure from Trump to shift iPhone assembly to the U.S., Apple is maintaining its production hubs in India and China to protect margins and supply chain stability amid ongoing concerns over tariff and cost.

– Trump claimed that India has offered to eliminate tariffs amid ongoing trade talks, but New Delhi called the negotiations complex, as both India and China navigate shifting U.S. trade pressure following a temporary U.S.-China tariff rollback.

– Asia-Pacific markets mostly rose as easing U.S.-China trade tensions lifted investor sentiment, though analysts remain cautious about a quick resolution, while gains in chip stocks and Nvidia’s rally further buoyed tech-heavy indexes.

– On May 10, China hosted a delegation of nearly 100 young and mid-career military officers from 40 African countries aimed at promoting PLA doctrines, military technologies, and defense cooperation, as part of Beijing’s broader strategy to cultivate long-term military cooperation with African states and counter the U.S. influence.

– China announced that its expanded “Golden Dragon 2025” military drills with Cambodia will showcase advanced technologies and greater PLA participation, reflecting Beijing’s deepening defense ties in Southeast Asia, while the U.S. sought to strengthen military ties with India and Vietnam.

– Pakistan has claimed that itdowned multiple Indian fighter jets using its Chinese-origin J-10C fighter jet. Rising tensions between nuclear-armed India and Pakistan following cross-border clashes have drawn international concern, with the U.S. offering mediation and China tacitly supporting Pakistan amid escalating regional stakes.

Associated News Sources:

“China imposes anti-dumping duties on industrial plastics,” CNN Business, May 18

“Apple Defies Trump, Retains India-China Production Hubs,” Yahoo Finance, May 16

“Trump says India has offered America ‘no tariffs’, but India says deal not yet complete,” CNN Business, May 15

“Asia-Pacific markets mostly higher as investors assess U.S.-China trade talk,” CNBC, May 13

“China hosts delegation of 100 African military officers to strengthen defense ties,” South China Morning Post, May 10

“China-Cambodia drills to showcase more tech and troops as military ties grow,” South China Morning Post, May 9

“China, US watch closely from the sidelines as India-Pakistan crisis unfolds,” South China Morning Post, May 8

– Chinese Defence Minister Dong Jun concluded his first European tour with pledges to enhance security ties with France and Germany and announced increased Chinese commitment to UN peacekeeping, signaling Beijing’s push to portray itself as a stabilizing global force.

– Hungary has declared that decoupling from China is a “red line,” with a senior official reaffirming Budapest’s commitment to Chinese trade and investment despite growing U.S. pressure on allies to pick sides.

– Newly inaugurated German Chancellor Friedrich Merz outlined a China policy that stressed both strategic de-risking and continued partnership—an approach critics deemed contradictory and potentially damaging to bilateral business ties. A week ago, President Xi Jinping congratulated Merz being elected.

– Chinese Defense Minister Dong Jun’s visit to France, the first to a major Western country in years, signals deepening China-France military ties and reflects Europe’s growing strategic autonomy and interest in diversified security partnerships amid strained transatlantic relations.

– On May 12, U.S. President Donald Trump sharply escalated tensions with Brussels by calling the European Union “nastier than China,” despite recently praising European Commission President Ursula von der Leyen.

– On May 9, Chinese President Xi Jinping attended Russia’s Victory Day parade in Moscow alongside Vladimir Putin, signaling strengthened Sino-Russian ties and joint opposition to U.S. influence, as both leaders vowed deeper political cooperation ahead of U.S.-China trade talks.

– President Trump signaled a willingness to cut tariffs on Chinese goods from 145% to as low as 60–80% to de-escalate the trade war, even as both countries remain far apart on deeper strategic concerns.

– Ukraine’s parliament ratified a minerals-for-investment deal with the U.S. that grants American entities joint control and profits over Ukraine’s vast critical mineral resources, while Trump considers it a critical step to secure critical mineral supply facing potential Chinese export control.

Associated News Sources:

“China’s defence chief forges Europe ties in Paris, Berlin plus UN peace pledge,” The South China Morning Post, May 16

“Beijing is a ‘red line’: Hungary vows it won’t decouple from China if pushed by Trump,” The South China Morning Post, May 15

“Germany’s new Chancellor delivers inauguration address, stance on China policy ‘contradictory’,” Global Times, May 15

“Chinese Defense Minister meets with French counterpart in France; carries positive significance in bilateral military ties: expert,” Global Times, May 13

“Trump: The EU is ‘nastier than China’,” Politico, May 12

“Xi and Putin vow stronger ties at Russia’s World War II Victory Day parade ahead of U.S.-China trade talks,” NBC News, May 9

“Trump tariffs live updates: Trump floats cutting slashing China tariffs to 80% with talks ahead,” Yahoo Finance, May 9

“Trump-Ukraine minerals deal gets green light from parliament in Kyiv,” Politico, May 8

– Colombia has applied to join the China-led New Development Bank and committed to purchasing $512 million in shares, marking a shift toward Beijing amid broader Latin American realignment away from Washington’s influence under Trump-era policies.

– APEC has projected regional export growth to slow to just 0.4% and economic growth to 2.6% amid rising U.S. tariffs, that now impact over half of its 21 members. Meanwhile, U.S. and Chinese trade envoys held bilateral talks aimed at easing escalating tensions.

– China will grant one-year visa-free entry to citizens of five Latin American countries starting June 1 to deepen regional ties and counter U.S. influence.

– President Trump unveiled a sweeping new Middle East strategy during his visit to Saudi Arabia—announcing $600 billion in Saudi investments in the U.S., lifting sanctions on Syria, urging Iran to strike a new nuclear deal, and calling on Saudi Arabia to join the Abraham Accords—all part of a pragmatic regional vision aimed at countering instability and China’s growing influence across the region.

– The Trump administration is preparing to announce a deal that would grant Saudi Arabia more access to advanced semiconductors. US officials are concerned about the potential for China to access these chips.

– President Xi Jinping met leaders including Brazil’s Lula, Chile’s Boric, and Colombia’s Petro, announcing future visa-free access for five nations and praising China-Latin America cooperation as a “great, sturdy tree.”

– Global markets rallied as the U.S.-China tariff truce sparked renewed investor optimism, with Asian stocks surging and recession fears easing, though economists and policymakers warned that lasting economic impacts and trade uncertainties remain.

– China reported an 8.1% surge in exports driven by booming trade with Southeast Asia, which offset a steep 21% drop in U.S.-bound shipments caused by triple-digit tariffs, as both countries prepare for high-stakes trade talks in Switzerland.

Associated News Sources:

“Colombia seeks to join China-based development bank as Latin America drifts away from Washington,” AP News, May 17

“APEC warns of stalling trade due to tariffs as China, US officials meet,” Reuters, May 15

“China allows visa-free entry for 5 Latin American nations to boost ties,” ABC News, May 15

“Trump lays out Mideast vision as he visits Saudi crown prince,” AP News, May 13

“US to Boost Saudi AI Chip Access Even as China Issues Linger,” Bloomberg, May 13

“China deepens ties with Latin America during Beijing forum,” DW, May 13

“Stocks Rise Across Asia on US-China Trade Truce: Markets Wrap,” Bloomberg, May 12

“China’s exports surge as shipments to Southeast Asian countries offset plunge in U.S. trade,” CNBC, May 8

– China unveiled its Jiutian SS-UAV—a high-altitude, AI-enabled mothership drone with swarm-launch capabilities—challenging U.S. air superiority, though its survivability against advanced missile defenses in contested regions like the Taiwan Strait remains uncertain.

– A former top U.S. general warned Congress that a Chinese invasion of Taiwan is no longer distant or theoretical, urging stronger deterrence as Beijing accelerates military preparations and U.S. officials emphasize Taiwan’s strategic importance.

– Japan has protested China’s construction of a new structure in the disputed East China Sea, accusing Beijing of unilateral resource development near the median line, escalating tensions with the U.S. ally amid broader regional concerns over China’s maritime expansion.

– China issued a sharp warning to the Philippines, a U.S. treaty ally, following a tense naval encounter near the contested Scarborough Shoal, while reports indicate that the US is planning to upgrade the Philippines’ military capabilities.

– On May 13, after President Trump made a “unification” comment at the White House, the U.S. de facto embassy in Taiwan reaffirmed that U.S. policy toward the island remains unchanged.

– Taiwan test-fired U.S.-supplied HIMARS rocket systems for the first time, signaling its growing readiness to assert its strategic deterrence capability. PRC has expressed concern over ROC’s sensitive movements.

– Japanese Prime Minister Shigeru Ishiba ruled out any trade deal with the U.S. that excludes auto tariffs, stressing that Japan won’t trade its agriculture market to protect autos, as Tokyo seeks a comprehensive agreement amid intensifying U.S. talks with both Japan and China.

– Taiwan marked VE Day by warning that both Europe and Taiwan face growing threats from an authoritarian bloc led by China, which is deepening ties with Russia to challenge the U.S.-led liberal order, while Taiwan strengthens unofficial ties with the U.S., including a visit by its foreign minister to Texas.

– On May 9, the Philippines launched an investigation into claims that sand dredged from its territory may have been used in China’s military island-building in the disputed South China Sea, as the U.S. further deployed special forces in Manila for a joint military exercise.

Associated News Sources:

“China’s Jiutian SS-UAV spooks US, challenges its air superiority, but can it outfly latest air defenses?,” The Economic Times, May 18

“Former U.S. Army Pacific Commander Warns Of Taiwan Invasion Risk,” MSN, May 16

“China Builds New Structure in Disputed Waters Claimed by US Ally,” Newsweek, May 16

“China Fires Warning at US Treaty Ally,” Newsweek, May 16

“US says Trump’s ‘unification’ comment was about US-China trade,” Reuters, May 13

“Taiwan test-fires new US-supplied HIMARS rocket system,” CNN, May 12

“Japan Won’t Do Trade Deal With US Excluding Autos, Ishiba Says,” Bloomberg, May 11

“Taiwan marks 80th anniversary of Victory in Europe Day by highlighting threats from China,” AP News, May 9

“Philippines to probe claims of sand dredging for Beijing’s South China Sea expansion,” The South China Morning Post, May 9

“G7 finance leaders to seek US consensus on non-tariff issues at Canada meeting,” Reuters, May 19

“China urges Germany not to undermine cooperation in name of ‘de-risking’,” Reuters, May 19

“Oil retreats as US and China growth concerns weigh,” Reuters, May 19

“China begins assembling its supercomputer in space,” The Verge, May 18

“Nvidia CEO says next chip after H20 for China won’t be from Hopper series,” Reuters, May 17

“Senior US Democrat slams reversal of AI rule as ‘horrible idea’ helping China,” South China Morning Post, May 17

“China Drops to Number Three Holder of Treasuries, Behind UK,” Bloomberg, May 16

“Trump Says He’s Willing to Travel to China for Xi Meeting,” Yahoo Finance, May 16

“Nvidia says it is not sending GPU designs to China after reports of new Shanghai operation” CNBC, May 16

“China Loosens Grip on Magnet Exports, Relieving Carmakers,” The Wall Street Journal, May 16

“China and Russia are deploying powerful new weapons: ideas,” Economist, May 15

“Trump administration considers adding Chinese chipmakers to export blacklist,” Financial Times, May 15

“China launches first of 2,800 satellites for AI space computing constellation,” Space News, May 14

“China launches first of 2,800 satellites for AI space computing constellation by Andrew Jones,” Reuters, May 14

Diverging Currents: U.S.–China Strategies on Deep Seabed Mining and the Future of Ocean Governance

By Nong Hong

May 16, 2025

In April 2025, the Trump administration issued an executive order authorizing the U.S. government to begin granting commercial licenses for deep seabed mining (DSM) in areas beyond national jurisdiction. The decision marks a significant policy shift, reflecting a renewed emphasis on national interest and access to critical minerals. While the order reaffirms longstanding U.S. concerns about the regulatory scope of the International Seabed Authority (ISA), it also introduces new tensions into an already delicate global effort to govern the seabed as a shared space.

In contrast, China has continued to pursue its seabed mining ambitions through formal engagement with the ISA, holding multiple exploration contracts and investing steadily in the technology and regulatory infrastructure required for eventual exploitation. These divergent approaches—one asserting national authority outside of the UNCLOS framework, the other operating within it—highlight broader differences in legal strategy, institutional engagement, and visions of global ocean governance.

Trump’s Crypto Ambition

Populism, Economic Strategy, and the Competition for Digital Future

By Yilun Zhang

May 9, 2025

In April 2025, the Trump administration issued an executive order authorizing the U.S. government to begin granting commercial licenses for deep seabed mining (DSM) in areas beyond national jurisdiction. The decision marks a significant policy shift, reflecting a renewed emphasis on national interest and access to critical minerals. While the order reaffirms longstanding U.S. concerns about the regulatory scope of the International Seabed Authority (ISA), it also introduces new tensions into an already delicate global effort to govern the seabed as a shared space.

In contrast, China has continued to pursue its seabed mining ambitions through formal engagement with the ISA, holding multiple exploration contracts and investing steadily in the technology and regulatory infrastructure required for eventual exploitation. These divergent approaches—one asserting national authority outside of the UNCLOS framework, the other operating within it—highlight broader differences in legal strategy, institutional engagement, and visions of global ocean governance.

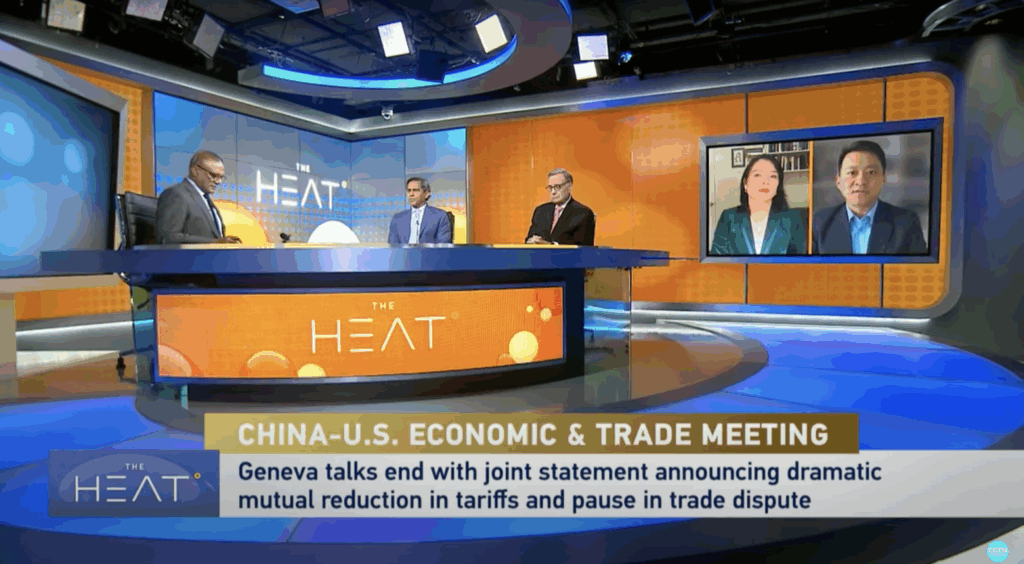

On Wednesday, May 14, 2025, Senior Fellow Sourabh Gupta was interviewed by CGTN America’s The World Today on the China-US trade meeting in Geneva.

On Sunday, May 10, 2025, Senior Fellow Sourabh Gupta was quoted by China Daily on the impact of tariffs on America.

On Tuesday, May 6, 2025, Senior Fellow Sourabh Gupta was interviewed by CGTN America’s The World Today on the outbreak of hostilities between India and Pakistan over Kashmir.

The Institute for China-America Studies is an independent nonprofit, nonpartisan research organization dedicated to strengthening the understanding of U.S.-China relations through expert analysis and practical policy solutions.

1919 M St. NW Suite 310,

Washington, DC 20036

icas@chinaus-icas.org

(202) 968-0595

© 2025 INSTITUTE FOR CHINA-AMERICA STUDIES. ALL RIGHTS RESERVED.