By Matt Geraci & Yilun Zhang

White House Deliberates Block on All US Investment in China

Eamon Javers and Yun Li

CNBC, September 27

“The White House is weighing a block on all U.S. investments in China, a source familiar with the matter told CNBC. The discussion is in its preliminary stage and nothing has been decided, the source said. There’s also no time frame for their implementation, the source added. This discussion includes blocking all U.S. investment in Chinese companies, the source told CNBC. Restricting investments in Chinese entities would be meant to protect U.S. investors from excessive risk due to lack of regulatory supervision, the source said. The deliberation come as the U.S. looks for additional levers of influence in trade talks, which resume on October 10 in Washington.”

US, China in Close Communication ahead of Next Round of Trade Talks

Ken Martin and Jonathon Garber

FOX Business, September 26

“The U.S. and China continue to prepare for the next round of trade talks in October. China’s Commerce Ministry said on Thursday that the two countries are in close communication about the next round of talks, according to Reuters. The next round is scheduled in two weeks. President Trump said the U.S. may reach a trade deal with China ‘sooner than you think,’ sending stock markets to the highest levels of the Wednesday trading session. ”

US Universities Report Drop in Students from China

Susan Shand

VOA, September 25

“For the past 10 years, the number of Chinese students at U.S. universities has been rising. But university officials are starting to see a sharp drop in Chinese students. Several universities have reported drops of 2 percent or more this autumn at the start of a new school term.”

“University officials and observers say there are several reasons for the falling numbers of Chinese students. They include trade conflicts and political tensions between China and the United States. There is also increasing competition for college students, visa issues and the growth of China’s higher education system.”

China is Sending Government Officials into Companies Like Alibaba and Geely

Laura He

CNN, September 24

“China is sending officials into some of the country’s biggest private companies in a move it says is designed to bolster high-tech manufacturing. Officials in the city of Hangzhou, a center of private enterprise in China’s Zhejiang province, will be dispatched to 100 companies in the region, including e-commerce giant Alibaba and automaker Geely, the local government said in a statement at the weekend.”

“The role of the ‘government affairs representatives’ is to foster communication and help businesses carry forward key projects, it added. It’s part of China’s ambition to become a tech superpower by moving its huge manufacturing industry up the value chain.”

Mnuchin: US-China Trade Talks to Resume Soon, Japan Deal Near

Matthew McNulty and Blair Shiff

FOX Business, September 24

“In the on-again, off-again world of trade talks, U.S. Treasury Secretary Steven Mnuchin said late Monday U.S.-China trade talks will resume in two weeks in Washington. During the interview with FOX Business’ Lou Dobbs on ‘Lou Dobbs Tonight’ on Monday, Mnuchin clarified how the trade negotiations are going. ‘The president’s been very clear if we can get the right deal, he wants the deal,’ Mnuchin told Dobbs. ‘If we can’t get the right deal, he’s happy with the tariffs.’”

“A new twist to Mnuchin’s comments, which were made at the United Nations General Assembly, is that the Trump administration had requested that Chinese officials cancel a visit to U.S. farming regions. A report by state-backed media group Yicai quoted a Beijing senior agricultural representative as saying that China did not cancel the planned visits to the U.S. because of challenges in trade negotiations. The visits by Chinese officials to farms in Montana and Nebraska were unexpectedly called off, but now, Mnuchin stated the cancellation ‘was purely at our request.’”

27 Countries Sign Cybersecurity Pledge with Digs at China and Russia

Keven Collier

CNN, September 23

“Twenty-seven countries have signed a joint agreement on what constitutes fair and foul play in cyberspace – with a nod toward condemning China and Russia. The statement, released on Monday at the United Nations ahead of the beginning of the UN General Assembly’s General Debate, is largely a broadly written agreement that countries should follow international law.”

“The signatories include the members of the Five Eyes intelligence alliance ( the United States, United Kingdom, Australia, New Zealand and Canada) as well as other major European nations, Colombia, Japan and South Korea. The signatories mirror the large group of countries involved in the previous two occasions who jointly blamed cyberattacks on one country, China, for a more than a decade-long hacking campaign, and Russia for creating the infamous NotPetya ransomware worm, which spiraled out of control and locked up computers around the world.”

Chinese Theft of Trade Secrets on the Rise, the US Justice Department Warns

Nancy Hungerford

CNBC, September 22

“As President Donald Trump puts pressure on Beijing to end unfair business practices, the Department of Justice has a warning for companies: Bolster your defenses. ‘More cases are opened that implicate trade secret theft – and more of them point to China, said U.S. Deputy Assistant Attorney General Adam Hickey.’”

“Since 2012, more than 80% of economic espionage cases brought by the department’s National Security Division have implicated China. The frequency of cases has been rising in recent years, according to Hickey. ‘That may be because the victims are more attentive to what’s happening, which is a good thing,’ Hickey told CNBC in Singapore on Saturday. ‘They may be more comfortable reporting to law enforcement, which is a good thing. They may be fed up, which is also a good thing.’”

China Detains Former U.S. Air Force Pilot Flying for FedEx

John Lyons and Wenxin Fan

The Wall Street Journal, September 20

“Chinese authorities have detained a FedEx Corp. pilot in the southern city of Guangzhou, elevating pressure on the express shipping giant that is already in Beijing’s crosshairs amid a U.S.-China trade war. The pilot, a former U.S. Air Force colonel named Todd A. Hohn, was detained a week ago while waiting for a commercial flight to his home in Hong Kong after flying deliveries throughout Asia from the FedEx regional hub in Guangzhou, people familiar with the matter said.”

“When he was detained, Mr. Hohn was carrying nonmetallic pellets used in low-power replica air guns in a checked bag, the people said. Chinese authorities have alleged that Mr. Hohn was illegally transporting ammunition and have begun a criminal investigation, the people said. On Friday, China’s foreign ministry confirmed that Guangzhou airport customs detained a FedEx pilot on suspicion of smuggling ammunition and later released him on bail. A ministry spokesman said a box of 681 air gun pellets was found in the man’s luggage.”

U.S. Outlines Plans to Scrutinize Chinese and Other Foreign Investment

Alan Rappeport

The New York Times, September 17

“The Trump administration proposed new rules on Tuesday that would allow the United States to exert greater control over foreign investment by broadening the government’s authority to block technology and real estate transactions.”

U.S., Chinese Trade Deputy Talks to Start on Thursday

David Lawder

Reuters, September 16

“Deputy-level U.S.-China trade talks are scheduled to start in Washington on Thursday, the U.S. Trade Representative’s office said, paving the way for high-level talks in October aimed at resolving a bitter 14-month trade war.”

China’s Slowdown Deepens; Industrial Output Growth Falls to 17-½ Year Low

Keven Yao and Stella Qiu

Reuters, September 15

“The slowdown in China’s economy deepened in August, with growth in industrial production as its weakest 17-½ years amid spreading pain from a trade war with the United States and softening domestic demand.”

China’s Clout is Growing on the Edge of the EU, and the US is Worried

Sebastian Shukla and Oren Liebermann

CNN, September 14

“The United States and Europe have watched as the Chinese footprint in Serbia has grown, shifting Belgrade from its traditional allies in the West to its new friend to the east. On the doorstep of the European Union, Serbia has made it clear that joining the EU is one of its strategic goals, but Belgrade’s recent moves have some questioning the country’s aim.”

“‘We’re trying to support them to move in one direction. They should be careful about where they’re going,’ US Ambassador to Serbia Kyle Scott told CNN.The Chinese firm that has drawn the most scrutiny from the US is Huawei, the world’s largest telecom equipment provider. Huawei is installing surveillance cameras in Belgrade as part of its ‘Safe City’ initiative. And there are plans for Huawei to build a 5G network in Serbia, despite US security concerns about the Chinese firm — concerns which the company has denied.”

China Taps Its Private Sector to Boost Its Military, Raising Alarms

Kate O’Keeffe and Jeremy Page

The Wall Street Journal, September 25

“Beijing is increasingly tapping private Chinese firms to acquire foreign technology for its military, according to officials and a new report, in a strategy that is prompting calls by leaders in Washington to retool U.S. national security policy.”

“… ‘China’s obfuscation and elimination of barriers between the defense and civilian sectors has troubling implications for foreign as well as domestic Chinese firms,’ a senior U.S. administration official said in a statement to The Wall Street Journal. China’s strategy is creating new risks that foreign companies and researchers inadvertently help the People’s Liberation Army, or PLA, acquire the technology and expertise it needs to enhance its already rapidly expanding capabilities, according to the C4ADS report released Wednesday. ”

China’s Soybean Move Lands With a Thud for U.S. Farmers

Brendan Murray

Bloomberg, September 24

“China’s latest gesture of goodwill in its trade war with the U.S. isn’t having much of an immediate effect where it matters most for President Donald Trump: on struggling American farms. Beijing gave new waivers to several domestic companies to buy U.S. soybeans free of the tariffs China imposed in retaliation for the Trump administration’s higher levies. The move gave soybean futures in Chicago a little lift initially Tuesday, but prices stayed below their highs of last week.”

“The muted uptick may be explained partly by the quantity of China’s potential purchases – reportedly between 2 million to 3 million tons, and some firms already bought about 1.2 million tons. That’s not a huge amount and would look like more normal purchases in the absence of Trump’s tariffs… Meanwhile, Trump gave his Treasury Secretary Steven Mnuchin a bizarre grilling over China’s targeting of U.S. agriculture, adding to the confusion about the short-term goals in the trade negotiations with a Chinese government that doesn’t seem overly worried about the economic fallout so far. As the U.S. administration tries to figure out how to proceed, this is an opportune moment for China to offer Trump olive branches to keep talks on track.”

Beijing Calling: Assessing China’s Growing Footprint in North Africa

Adel Abdel Ghafar and Anna L. Jacobs

Brookings, September 23

“China is expanding its cooperation with North African countries, not only in the economic and cultural spheres, but also those of diplomacy and defense. Furthermore, it is showcasing a development model that seeks to combine authoritarianism with economic growth — a model that has an eager audience among regimes across the MENA region. As such, China’s growing role in North Africa is likely to have far-reaching economic and geopolitical consequences for countries in the region and around the world.”

“As part of these policy recommendations, this briefing argues that China’s engagement should be cautiously welcomed, but also closely monitored, by governments in North Africa, Europe, and the United States. North African governments should be wary of Chinese “debtbook diplomacy” and surveillance, while Western governments should be wary of the security consequences of an increased Chinese presence in the Mediterranean. Moving forward, China, North Africa, Europe, and the United States should seek win-win modalities of engagement that bring prosperity and stability to the Mediterranean basin.”

China’s Giant $400 Billion Iran Investment Complicates U.S. Options

Ariel Cohen

Forbes, September 19

“At a time when many nations are becoming more wary of Chinese investment – including companies across Europe, Greenland, and the Central Asian Republics – Iran is further embracing China and less savory actors like Russia, and Turkey.”

“Overall, this may not prove a financially sound endeavor by Beijing, as Chinese companies will come under U.S. sanctions – but it may end up as a shrewd geostrategic play by both parties. Profitability certainly hasn’t been China’s main motivation in many previous investment schemes, nor is it Iran’s. This case is no different. It is a geopolitical anti-American axis. China’s game here is clear: first, increase tensions between the U.S. and Iran by weakening the impact of American sanctions and increase their soft power leverage in the energy-dense Middle East. Then integrate Iran into the Belt-and-Road initiative and into the Shanghai Cooperation Organization, of which Tehran is an observer member. ”

Trade and Technology: Assessing US-China Multi-Domain Competition

Event hosted by Cathay Review, September 12, 2019

China’s Rise in Eurasia

Event hosted by CSIS, September 12, 2019

Japan, Taiwan, and the Future of “America First” Trade Policy

Event hosted by Brookings, September 17, 2019

Rare Earths, 5G, and How the US Should Respond to Chinese Tech’s Rising Global Influence

Event hosted by YCW, September 19, 2019

The 7th Asia-Pacific/Arctic Maritime Security Forum

Event hosted by the China Institute at the University of Alberta, National Institute for South China Sea Studies, Institute for China-America Studies, and Dalhousie University, September 23-26, 2019

Beyond the Brink: Escalation Dominance in the U.S.-China Trade War

Event hosted by CSIS, September 25, 2019

9th Annual China Defense and Security Conference

Event hosted by The Jamestown Foundation, October 15, 2019

The U.S.-China Technology Relationship in Flux

Event hosted by Brookings, October 4, 2019

The U.S.-China Trade and Strategic Relationship/Rivalry

Event hosted by The Washington International Trade Association, October 2, 2019

Global China: Assessing China’s Growing Role in the World and Implications for U.S.-China

Event hosted by Strategic Competition, October 1, 2019

Strategies and Resources for Protecting IP in China with the USPTO

Event hosted by The US-China Business Council, October 1, 2019

By Matt Geraci and Yilun Zhang

Introduction

The U.S.-China bilateral relationship has an enormous impact on Asian geopolitics as well as the international system and has become increasingly complex on both a security and macroeconomic level.

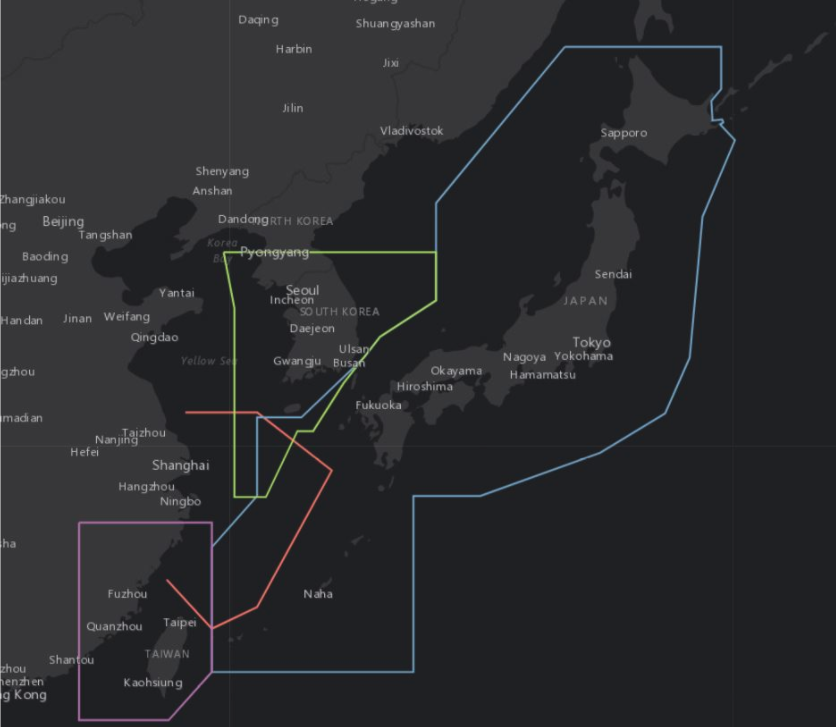

The rise of China in the maritime domain has altered the security and economic dynamics between the U.S. and its allies in the South China Sea, the East China Sea, and the Arctic. Through combining GIS with policy research, the Institute for China-America Studies (ICAS) seeks to organize and streamline these complex issues into an interactive database to create a platform that empowers and educates scholars, policymakers, students and the media through data transparency, intellectual collaboration, and well-informed analysis. In essence, the maritime trackers are living documentation of the most relevant issues and trends related to maritime security and maritime economy.

A number of maps produced by governments or research institutions display claims to maritime jurisdiction. However, many of these maps can lead to confusion and give a false impression of what the actual international claims are, as they often do not differentiate between an internationally submitted claim and a maritime rights claim featured in national legislation. Furthermore, a number of maps may also try to ‘connect the dots’, meaning that an attempt is made to connect points or lines on partial submissions or non-demarcated territorial limits to display a map that appears more complete. The trackers that ICAS produces visually differentiate each claimant’s internationally submitted maritime claims from claims made through national legislation and display all submissions/partial submissions exactly as they were presented to international bodies, such as UNCLOS.

Why the East China Sea

The neighboring parties in the East China Sea region constitute roughly a quarter of the world’s population and nearly a quarter of the world’s economy. Therefore, both economic and security dynamics in the region have a significant impact on global security and economic well-being.

On an economic level, the region is home to important fisheries, hydrocarbon resources, and shipping routes. However, due to long-standing territorial and maritime disputes, stakeholders in the region compete over the rights to access and exploit these resources. In particular, debates over sovereignty and maritime rights in the vicinity of the Diaoyu/Senkaku/Diaoyutai Islands and the Dokdo/Takeshima Islands have led to rising tensions and standoffs in the East China Sea.

From a security perspective, the East China Sea is one of the most strategically important areas for China. The region must remain stable to guarantee sustainable economic growth. Not only is the East China Sea one of the only two access points for China to major oceans, but in addition most of China’s developed cities reside on the eastern shore.

China is currently undergoing a naval modernization program that comports with its evolving role as a rising global power. In its 2015 military textbook The Science of Military Strategy, China indicated that the role of its navy has shifted from “near-sea defense” to “far-sea protection”. China follows an “active defense” doctrine, which directly influences its offshore defensive strategy. In addition, China believes that it needs a modern blue-water navy to support its growing ocean-faring interests, including the protection of its sea lines of communication.

The region is also very important to the U.S. and other Asian powers, including South Korea, Japan and Taiwan. The United States sees the region as essential to its forward-deployed posture of securing a favorable strategic balance in the Indo-Pacific region. While the U.S. relies on its allies in the region to support its great-power competition with China, its military dimension impacts the strategic and power dynamics in the region.

Within the constraints of Japan’s pacifist constitution, the Abe administration, too, has sought to boost Japan’s defense capability. The Japan Self-Defense Force is currently developing strong stand-off capabilities to defend its southwestern remote islands, including the deployment of rapid reaction forces from its main islands.

Given its manpower constraints, Taiwan’s defense strategy focuses on establishing multilayer defense and creating asymmetric local superiority against a potential amphibious invasion. In this regard, Taiwan’s military has been seeking out more purchases of cutting-edge U.S. weapons and equipment.

Phase I of the East China Sea Tracker

On June 14, 2019, ICAS published its pilot tracker on Freedom of Navigation Operations (FONOP) in the South China Sea. Taking lessons learned from the FONOP tracker, we are now entering into the first phase of the East China Sea Tracker. For the sake of completeness, we include the Yellow Sea and the Japan Sea regions in the East China Sea Tracker to incorporate the full extent of maritime claims, economic activities, and security elements.

Phase I of the East China Sea Tracker focuses on three main elements:

● Maritime Claims

● Maritime Economy

● Maritime Security

The Maritime Claims Trackers explore long-standing territorial and maritime rights disputes that largely remain unsettled to this day. We make a distinction between claims that have been submitted to international bodies, following the entry into force of the United Nations Convention on the Law of the Sea (UNCLOS), and claims that are more rooted in national laws and norms. In areas where maritime boundaries are in dispute, we show the claims of each party based on the best publicly available information. ICAS emphasizes that these maps are not to be taken as an endorsement of any one party’s respective claims over another’s.

The Maritime Economy Trackers emphasize economic activity in this maritime region. Given the overlapping and disputed sovereign rights and jurisdiction claims in the East China Sea, economic activity, such as commercial fishing and hydrocarbon exploration/exploitation, has necessarily become highly politicized in some cases. This has led to disputes regarding the access and utilization of potential and existing resources. As such, the first two economic trackers place an emphasis on fishery agreements and hydrocarbon exploration/exploitation.

The Maritime Security Trackers explore power dynamics in the region that have a direct impact on China, the U.S., and other parties with strategic interests in the region. In the first phase of the ECS tracker, we seek to show the power dynamics between China, Japan, the U.S. Force Japan, and Taiwan.

Phase II of the East China Sea Tracker

Phase I of the ECS Tracker places emphasis on the U.S.-China, U.S.-Japan, and Japan-China relationships. In Phase II, the aim is to provide a broader snapshot of the region writ-large, as well as cover geographic theaters that have hitherto been covered lightly or skipped altogether. These include the evolving strategic dynamic in the Taiwan Strait, in the Sea of Japan/East Sea featuring the two Koreas as well as Japan, in the Northern Pacific featuring Russia and Japan and in the Western Pacific, featuring the U.S.’ deployments in Guam and in and around the second island chain. Where parties have competing sovereign rights and jurisdiction claims in the relevant sea areas, these will be mapped out too.

As the East and South China Seas are connected physically, so too are many economic and security elements in both seas. Therefore, once revisions and new additions take place during the second phase of the South and East China Sea trackers, ICAS plans to connect the two seas together.

Conclusion

In the backdrop of increasingly tense bilateral relationships, such as the U.S.-China relationship and the Japan-South Korea relationship, it is the goal of ICAS to use these trackers to build a platform for intellectual exchange that spans across institutions and sectors to promote greater multilateral cooperation and regional stability. As more trackers continue to be developed in the near and long term using new data tools and programs, the scope and breadth of study will grow as well. In this regard, the platform will become an online community and forum that welcomes both data sharing and discussion that allows for fact-checking and deeper analysis.

Matt Geraci is a Research Associate & Program Officer at the Institute for China-America Studies.

Yilun Zhang is a Research Assistant at the Institute for China-America Studies.

The Institute for China-America Studies is an independent nonprofit, nonpartisan research organization dedicated to strengthening the understanding of U.S.-China relations through expert analysis and practical policy solutions.

1919 M St. NW Suite 310,

Washington, DC 20036

icas@chinaus-icas.org

(202) 968-0595

© 2025 INSTITUTE FOR CHINA-AMERICA STUDIES. ALL RIGHTS RESERVED.