Amidst growing criticism of the Belt and Road Initiative’s fossil fuel investments, Xi Jinping’s keynote speech at the April 25-27 Belt and Road Forum for International Cooperation sought to assuage these concerns and reaffirm Beijing’s commitment to green development. Xi touted both the BRI’s UN partnerships and other internal mechanisms such as the BRI Environmental Big Data Platform, which Xi claims are designed to promote sustainable development and “protect the Earth which we all call home.” Nonetheless, the BRI’s history of large investments in fossil fuels, opaque funding, unclear definition, and issues related to local implementation leaves many observers skeptical of Beijing’s likelihood to follow through on its rhetoric.

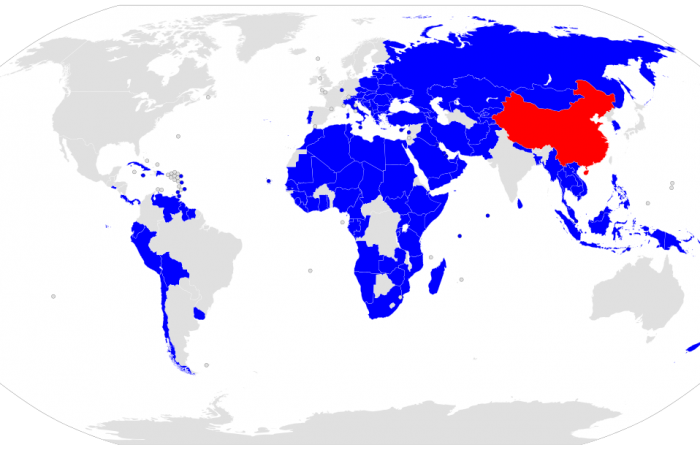

The Belt and Road Initiative, commonly abbreviated as BRI, was first unveiled in 2013 during Xi’s official visits to Kazakhstan and Indonesia. Officially, the Belt and Road Initiative aims to link participating entities via a vast network of roads, ports, pipelines and railways, although some of its detractors view it as little more than a public relations campaign for “poorly connected” infrastructure projects. In any case, the BRI has attracted a total of over 150 signatory countries and international organizations since its inception, including the African Union and ASEAN, and Chinese enterprises invested over $90 billion in BRI partners between 2013 and 2018. While the Chinese government officially maintains that the BRI is a “win-win” strategy to promote growth and connectivity among partner countries, there are concerns the BRI is being used to help Beijing project geopolitical power overseas, alleviate domestic overcapacity at the expense of local economies, and rewrite international norms and institutions.

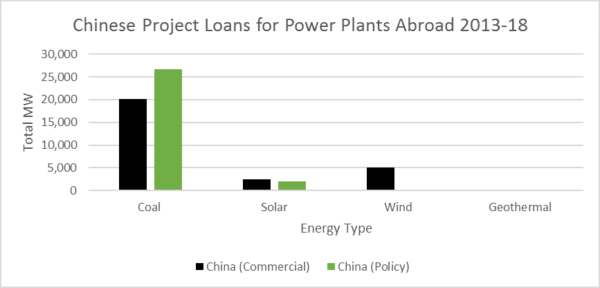

The massive scope and scale of the BRI’s energy projects also makes it a key deciding factor in the future of climate change. Despite official rhetoric about promoting sustainable development, Han Chen of the Natural Resources Defense Fund notes a conspicuous contradiction in fossil fuel investments associated with the BRI. A joint report by the World Resources Institute and Boston University found that between 2014 and 2017, 43% of energy-related loans by the China Development Bank and Export Import Bank of China went to oil, gas, and petrochemicals and 18% went to coal. Meanwhile, only 3.4% went to solar and 2.9% went to wind. By comparison, 25% of the World Bank’s active energy loans were allocated towards renewable energy. Current estimates by the Institute for Energy Economics and Financial Analysis indicate that China has committed more than $20 billion in total towards coal plants so far.

Such environmental concerns have not gone unnoticed in BRI partner countries either. Dealing a blow to the BRI’s image ahead of the G20 summit in Osaka, a Kenyan court halted construction on a Chinese-financed $2 billion coal plant that would have increased Kenya’s greenhouse gas emissions output by 700%, citing an inadequate environmental assessment. Similarly, although the BRI-backed Tuzla 7 coal plant is still operational, it has sparked public outcry in Bosnia and Herzegovina and faced numerous legal challenges from environmental groups. Issues like these, among others such as partner countries’ allegations of rushed environmental assessments and “exploitative” loans, challenge the BRI’s wholly green and mutualistic development narrative. Indeed, the BRI’s stated goal of alleviating poverty seems ironic given that the poor tend to disproportionately bear the burdens of pollution and climate change.

Interestingly, the story of green development is different within China’s borders. Although China currently remains the largest emitter of greenhouse gases, burning half the total coal consumed globally in 2017, it has also become the greatest producer of green energy, and its green energy market is currently growing faster than that of fossil fuels. Furthermore, in 2017 alone, China built a whopping 13% of the world’s current total solar capacity within its borders. In short, while still having a long road ahead, China is taking huge strides in developing greener energy domestically.

Additionally, despite the small proportion of green energy investment relative to fossil fuel under the BRI, Beijing also has undertaken solar and wind projects overseas in places like the UAE and Kenya. For example, China filled a gap left by Western financiers in Argentina’s ambitious solar goals by building a Jujuy province solar plant in early 2019, currently Latin America’s largest. By some estimates, China is projected to pledge an additional over $6 trillion to green energy over the next two decades.

Chinese energy loans for overseas power plants by energy type, in megawatts

Chinese energy loans for overseas power plants by energy type, in megawatts

Source: https://www.nrdc.org/experts/han-chen/greener-power-projects-belt-road-initiative-bri

As such, despite geopolitical and economic fears from Western powers, the BRI does not need to be a zero-sum game in terms of climate change. Jeffery Ball, an energy scholar at the Brookings Institution, points out that while China’s green energy push is mostly driven in terms of profitability rather than climate concerns per se, it has already become a major global innovator in areas such as power transmission and electric cars. China’s desire to expand and export its burgeoning green tech industry, coupled with state support in economic policy, makes it poised to supply the world with not only green energy, but also low-emissions transport infrastructure like high-speed rails.

Ultimately, it is in both China and partner countries’ self interest to prioritize green development and responsible financing. Notwithstanding the economic implications of pollution and climate change, partner countries saddled with unsustainable debt will be distrustful of Chinese leadership. Moreover, renewable energy projects are often both more popular and more economically feasible in the long term than coal plants. Instead of merely following often-weak local environmental laws, China needs to follow through on its rhetoric and develop high, unified internal standards for projects seeking BRI support. At least reaching, if not surpassing, the World Bank’s standards of green energy projects could be a good start. Finally, as rival powers propose alternatives such as Japan’s at the G20 summit, China will need to recalibrate its financing schemes and improve transparency to compete in international development and to maintain a positive global image.