In March 2024, five major labor unions—including the United Steelworkers (USW)—petitioned the Biden administration to investigate what they described as China’s “unreasonable and discriminatory” practices in the maritime, logistics, and shipbuilding sectors. Shortly after that, the Office of the United States Trade Representative (USTR) launched a Section 301 investigation, concluding in January 2025 that China’s shipbuilding industry was supported by massive state subsidies, intellectual property violations, market access restrictions, and suppressed labor costs. The findings were further discussed in public hearings in March 2025, where lawmakers emphasized that Chinese dominance poses a direct threat to U.S. industrial and strategic capacity.

These new dynamics come amid an increasingly stark gap between the U.S. and China in shipbuilding industrial capacity. According to Visual Capitalist, China delivered 32.86 million gross tons (GT) of ships in 2023, while the United States produced just 60,000 GT. Clarkson Research also reported that in 2024, Chinese shipyards secured 46.45 million compensated gross tons (CGT) in new orders—71% of the global total. South Korea followed with 10.98 million CGT, while the U.S. failed to register.

In fact, U.S. concerns over its own shipbuilding industry have been repeatedly reflected in planning documents and legislative initiatives in recent years. As early as 2019, the U.S. Navy’s 30-Year Shipbuilding Plan proposed expanding the naval fleet to 355 combat ships by mid-century, backed by an annual investment of $40 billion. In 2024, the Navy Force Structure and Shipbuilding Plans report from the Congressional Research Service outlined dozens of policy recommendations to enhance domestic shipbuilding capacity, including accelerated hiring and training, increased automation, and the construction of new shipyard facilities. In December 2024, Mike Waltz and Senator Mark Kelly introduced the SHIPS for America Act, a bipartisan bill aimed at restoring U.S. shipbuilding leadership through targeted investments and procurement reforms.

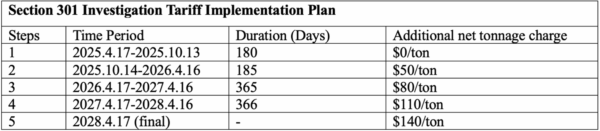

On April 17, 2025, the Office of the U.S. Trade Representative announced that, following a year-long Section 301 investigation, the U.S. would impose new port fees and tariffs on China-related vessels and port equipment. The measures represent a scaled-back version of the February 2025 proposal, which had called for fees of up to $1.5 million per port call for China-built ships.

The finalized plan will roll out in two phases, beginning with a 180-day exemption period. After that, Chinese vessel owners and operators will be charged based on a ship’s net tonnage per U.S. voyage, starting at $50 per ton and increasing by $30 annually, reaching $140 by 2028. The fee will apply at the first port of entry per rotation and be capped at five charges per year. The plan also introduces a service fee targeting foreign-built vehicle carriers, calculated by Car Equivalent Unit (CEU) and set at $150 per CEU after the grace period.

First, while the U.S. government aims to counter China’s dominance in shipbuilding through its new port fee regime, the strong backlash it has triggered underscores the challenges of translating strategic ambition into effective industrial policy. Specifically, the U.S. government is attempting to use protectionist tools in a globalized industry where few affordable alternatives exist. Tariffs and port fees alone are unlikely to reverse decades of decline without a systematic industrial policy that supports investment in infrastructure and workforce training. Moreover, it remains unclear what strategic objective these protectionist policies aim to achieve. Without clear benchmarks for success, these measures risk becoming symbolic gestures rather than a coherent industrial strategy.

Second, the new measures targeting the global shipbuilding industry are redistributive in nature and may create new winners and losers. For China, these measures could raise operating costs and intensify competitive pressure on its shipbuilding firms in the short term, potentially weakening their global competitiveness. At the same time, the restrictions may prompt shipping companies to favor South Korean and Japanese vessels, diverting orders away from Chinese yards. However, given limited capacity, labor shortages, and rising costs in both Japan and South Korea, it remains uncertain whether their industries can fully absorb the overflow. Combined with the absence of a coherent U.S. industrial strategy, it remains difficult to predict who will ultimately emerge as the beneficiaries—or bear the costs—of this global restructuring.

This Spotlight was originally released with Volume 4, Issue 4 of the ICAS MAP Handbill, published on April 29, 2025.

This issue’s Spotlight was written by Zichong Ye, Long-term Research Assistant Intern.

Maritime Affairs Program Spotlights are a short-form written background and analysis of a specific issue related to maritime affairs, which changes with each issue. The goal of the Spotlight is to help our readers quickly and accurately understand the basic background of a vital topic in maritime affairs and how that topic relates to ongoing developments today.

There is a new Spotlight released with each issue of the ICAS Maritime Affairs Program (MAP) Handbill – a regular newsletter released the last Tuesday of every month that highlights the major news stories, research products, analyses, and events occurring in or with regard to the global maritime domain during the past month.

ICAS Maritime Affairs Handbill (online ISSN 2837-3901, print ISSN 2837-3871) is published the last Tuesday of the month throughout the year at 1919 M St NW, Suite 310, Washington, DC 20036.

The online version of ICAS Maritime Affairs Handbill can be found at chinaus-icas.org/icas-maritime-affairs-program/map-handbill/.

The Institute for China-America Studies is an independent nonprofit, nonpartisan research organization dedicated to strengthening the understanding of U.S.-China relations through expert analysis and practical policy solutions.

1919 M St. NW Suite 310,

Washington, DC 20036

icas@chinaus-icas.org

(202) 968-0595

© 2026 INSTITUTE FOR CHINA-AMERICA STUDIES. ALL RIGHTS RESERVED.