Photo: The White House

Resident Senior Fellow

The Foreign Investment Risk Review Modernization Act (FIRRMA) of 2018, signed into law on August 13, 2018, is the most consequential update to the rules governing the Committee on Foreign Investment in the United States (CFIUS), an inter-agency body that vets foreign inward investment transactions, since the passage of the Foreign Investment and National Security Act (FINSA) of 2007.

FIRRMA’s key innovation is the closing of investment screening-related loopholes related to the acquisition, and potential leakage, of American “critical technologies” – much like FINSA had brought American “critical infrastructure” fully within the CFIUS review net in the late-2000s.

The goals of FIRRMA are two-fold: First, to subject state-owned, state-funded or state-linked FDI transactions from “countries of special concern” that have a declared strategic goal of acquiring critical technologies that could undermine U.S. national security leadership to qualitatively greater scrutiny. Second, to shut down gaps within the CFIUS process that could otherwise enable a foreign entity, particularly a state-owned or state-linked entity, to exploit minority position investments in early stage U.S. technology companies and gain access to cutting-edge intellectual property and trade secrets.

FIRRMA does not depart from CFIUS’ original focus on national security and introduce variables such as industrial competitiveness nor does it explicitly identify countries (read: China) that are to be subjected to additional critical scrutiny. How broadly or narrowly the FIRRMA-related regulations are written and interpreted will be key to ensuring how broadly or narrowly FIRRMA’s perimeter around “critical technologies” is drawn.

FIRRMA appears to have been deliberately written with China’s merger, acquisition or takeover-related investments in the U.S. in mind and the law will have a dampening effect on two-way U.S.-China investment and technology transfers. However, there is a silver lining for China. The new FIRRMA legislation presents an incentive and opportunity for Beijing to liberalize its foreign inward investment and foreign equity joint ventures regimes in order to cultivate an organically-robust, high-technology, domestic manufacturing eco-system.

Foreign direct investment (FDI) is an integral part of an open and effective international economic system and a major catalyst for development and growth. Economic theory and empirical evidence confirm that FDI has a large, beneficial impact on the host country. Foreign ownership of domestic assets reflects confidence in a nation’s long-term economic outlook. However, the form and circumstances in which foreign direct investment is realized can be controversial.

During the latter years of the post-war Bretton Woods era (1945-73), Western European governments and companies routinely railed against the increasing inroads of U.S. corporate control of strategic sectors within their economies due to the secular overvaluation of the U.S. dollar. Because the price between the dollar and other national currencies, and as a corollary between the dollar and gold, was fixed in the Bretton Woods system, the dollar’s overvaluation – while handicapping the development of America’s export industries – made foreign corporate acquisitions cheaper and tended to encourage more U.S. overseas investment than would have been the case if the greenback had traded at equilibrium value in forex markets. The cost of increasing susceptibility to takeover by American corporate interests did not sit comfortably with European leaders and industrialists.

In the mid-and-late 1980s, it was Japan’s turn to feel the brunt of U.S. hostility as Tokyo’s acquisitions in a diverse range of U.S. manufacturing and non-manufacturing sectors on the back of its large trade surpluses touched off racially-tinged denunciations of Japan’s mercantilist and technology transfer practices. Trumped at his own game in Manhattan’s real estate sector, Donald Trump summed up the prevailing sentiment in his memorable quip that:

“The Japanese have their great scientists making cars and VCRs and we have our great scientists making missiles so we can defend Japan. Why aren’t we being reimbursed for our costs? The Japanese double-screw the US, a real trick: First they take all our money with their consumer goods, then they put it back in buying all of Manhattan. So either way, we lose.”

Japan’s illiberal foreign inward investment regime, which placed an insurmountably high bar on reciprocal purchases of equivalent firms in the Japanese corporate marketplace, compounded the sense of unfairness. Japan’s experience of the 1980s foreshadow many of the criticisms leveled against China today.

The Committee on Foreign Investment in the United States (CFIUS) is an inter-agency body established by executive order in 1975 and authorized by law to review any merger, acquisition or takeover that could result in the control of a U.S. business by a foreign individual or entity. CFIUS is composed of the heads of the Department of the Treasury, State, Defense, Justice, Commerce, Energy, and Homeland Security as well as the Office of the United States Trade Representative and the White House Office of Science and Technology Policy. The Secretary of the Treasury chairs the committee.

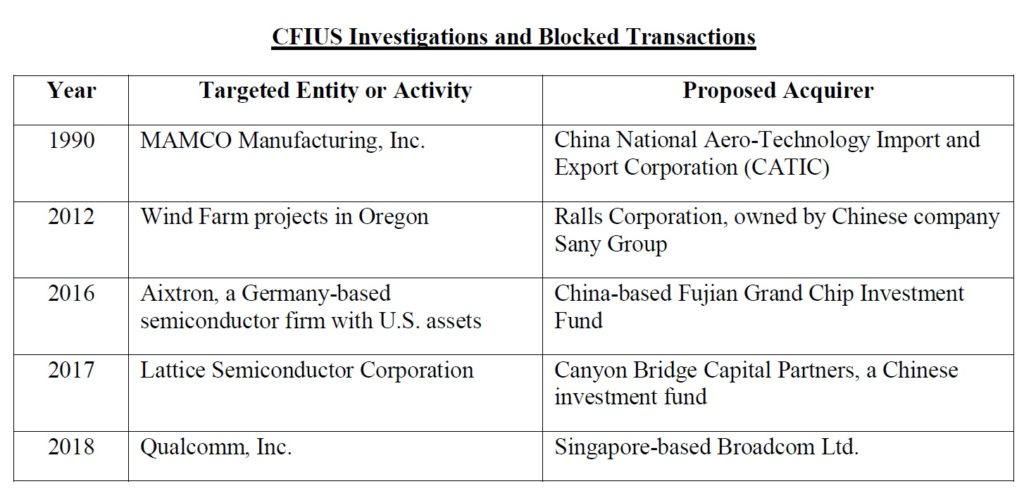

The purpose of a CFIUS review is solely to determine the effect of a foreign merger, acquisition or takeover transaction from a national security standpoint. In the instance that a transaction is deemed to pose a serious national security risk that is not amenable to satisfactory resolution, the President – on the advice of the committee – enjoys the authority to suspend or prohibit the transaction. So far, only five such transactions have been blocked by a President in the multi-decade long history of the CFIUS process. Three of the blocked transactions have however been within the past six years and pertained to China-linked entities. By-and-large, the vast majority of problematic transactions are screened out before the presidential decision stage. For example, in the years 2009 through 2015, companies filed 770 notices of transactions that underwent CFIUS review. Of the 770 transactions, as many as 80 transactions were withdrawn (almost 10 percent) by the companies/entities involved themselves during the review stage or the commencement of investigation stage.

The President’s legislative mandate to suspend or prohibit certain foreign merger, acquisition or takeover transactions derives from the 1988 Exon-Florio amendment that Congress enacted to the Defense Production Act of 1950. The mid-1980s was a period of hysteria over Japanese foreign acquisitions in the U.S. (not least within New York’s real estate sector where Donald Trump was a rising real estate mogul) and Exon-Florio authorized the President to investigate the impact of such acquisitions of U.S. entities by a foreign controlling interest on grounds of national security. The president delegated this investigative authority to CFIUS.

The next comprehensive update of CFIUS-related regulations took place in the late-2000s following the attempt of Dubai Ports World (DP World) to acquire Peninsular and Oriental Steam Navigation Company (P&O), a British firm which owned or leased terminal facilities in six U.S. ports (Baltimore, Houston, Miami, New Orleans, Newark, and Philadelphia). The politicization of the transaction in the post 9/11 age of anti-Arab alarm led to the passage of the Foreign Investment and National Security Act (FINSA). FINSA’s key reform was to subject the foreign acquisition of “critical infrastructure” to special scrutiny. In particular, acquisitions that involved “control” by a foreign government were mandated to undergo both an initial 30-day investigation and a more-detailed subsequent 45-day examination. The definition of “control” was widened to and, in the process not limited solely to majority foreign government ownership.

The Foreign Investment Risk Review Modernization Act (FIRRMA) of 2018 constitutes the third comprehensive updating of the United States’ foreign inward investment screening regime – this time, in response to the acquisition and potential leakage of American high technology to strategic competitor nations, such as China. Prior to the passage of FIRRMA, an empirically narrow ‘national security’ assessment framework has guided the approach of the Committee. Ted Moran, a top expert on CFIUS has characterized it as thus:

“… only if the US firm to be acquired controls access to a critical good or service that does not have substitutes in the international market, or if the US firm to be acquired gives over a sensitive semi-unique technology that could be deployed at great cost against US interests, or if the target US firm could be used for penetration or surveillance in ways damaging to the United States without the ability of US users to switch to other more secure alternatives, or if the target US firm has properties close to US military installations so as to allow surveillance, might a credible threat to national security [that would require CFIUS-mandated mitigation, modification or denial would] be present (Moran, 2017).”

On March 22, 2018, the United States Trade Representative (USTR) released its Section 301 investigation findings of China’s technology transfer, intellectual property rights (IPR) and innovation policies. In the chapter on China’s outbound foreign direct investment policies and practices, USTR determined that:

the Chinese government directs and unfairly facilitates the systematic investment in, and acquisition of, U.S. companies and assets by Chinese companies, to obtain cutting-edge technologies and intellectual property (IP) and generate large-scale technology transfer in industries deemed important by state industrial plans. The role of the state in directing and supporting this outbound investment strategy is pervasive …the government has devoted massive amounts of financing to encourage and facilitate outbound investment in areas it deems strategic … [and] enlisted a broad range of actors to support this effort, including SOEs, state-backed funds, government policy banks, and private companies.

These policies and practices, USTR found, threatened the competitiveness of U.S. industry, undermined the ability of U.S. firms to sustain innovation, distorted markets in high-technology products, and potentially damaged U.S. national security – broadly conceived – over the medium and long term.

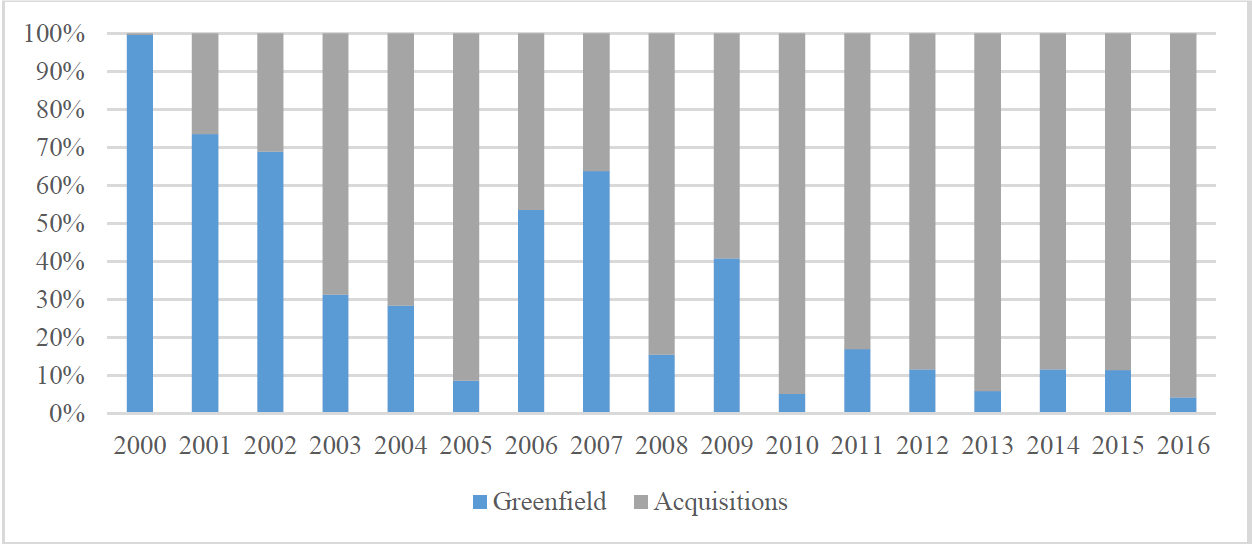

The sense of alarm in U.S. circles surrounding China’s outbound investment policies and practices is primarily a function of two factors: (a) its rapid rise in the United States from almost negligible amounts until 2010, and (b) the form and nature of such investments in the United States in the period since. As late as 2009, the combined value of China’s annual investments in the United States was below $1 billion. By the mid-2010s, the outbound investment landscape had changed dramatically. In 2016, Chinese entities invested a record $46 billion in the United States, a ten-fold increase from just five years earlier. More problematically, the vast majority of these investments were in the form of acquisitions rather than preferred greenfield investments – an accentuation of trends from a decade earlier. Between 2005-2009, greenfield investments accounted for 22 percent of Chinese outbound flows to the United States; by 2010-2016, 92 percent of such outbound flows were in the form of acquisitions. This in turn suggested that Chinese state-linked companies were buying out America’s ‘crown jewels’, including emerging and foundational technologies, that could have lasting impact on U.S. national security. China’s State Council’s Made in China 2025 Notice, which seeks to achieve 70 percent self-sufficiency by 2025 in core components and critical materials related to ten strategically advanced technology manufacturing industries, has only exacerbate these suspicions.

The reality is that 2016 represented the high-water mark of Chinese acquisitions in the U.S. marketplace and most of the acquisitions were in non-strategic sectors. These included Qingdao Haier’s $5.6 billion acquisition of GE’s appliances business, Anbang’s $5.5 billion purchase of 15 properties from Strategic Hotels, Wanda Group’s $3.5 billion deal to buy Legendary Entertainment, HNA’s $6 billion acquisition of Ingram Micro and Apex Technology’s $3.6 billion acquisition of Ingram Micro (Rhodium Group, 2017).

Nevertheless, pursuant to USTR’s Section 301 findings, Donald Trump issued a Presidential Memorandum on March 22, 2018 directing his Treasury Secretary to provide a strategy, including erecting investment restrictions, to address concerns about investment directed or facilitated by China in industries or technologies deemed important to the United States. The Administration performed a three-month review to examine whether to trigger the International Emergency Economic Powers Act (IEEPA) – which gives the president broad authority to regulate cross-border commerce – vis-à-vis China, or stick to expanding the regulatory jurisdiction of CFIUS. It chose the latter, more moderate, option in late-June 2018. And the Foreign Investment Risk Review Modernization Act (FIRRMA), a bipartisan bill introduced by U.S. Senators John Cornyn (R-TX) and Dianne Feinstein (D-CA), was selected as the legislative vehicle to enact this regulatory expansion into law. President Trump signed FIRRMA into law on August 13, 2018.

FIRRMA does not explicitly target China nor does it broaden its focus beyond considerations of national security to introduce variables such as industrial competitiveness. It addresses national security risks posed by foreign investment in the United States, regardless of where the investment originates. This having been said, there are a number of provisions that are designed to ensnare and subject both China-originating merger, acquisition or takeover transactions in the United States as well as China-bound U.S. foreign direct investments and technology transfers to markedly more granular checks.

At its core, FIRRMA requires CFIUS to scrutinize any merger, acquisition or takeover of a U.S. company or “other investment” in a U.S. company by a foreign entity that could lead to the disclosure of “material non-public technical information” related to sensitive personal data, critical infrastructure or critical technologies with a fine-tooth comb. Equally, on the export control front, an on-going inter-agency process to identify “emerging and foundational technologies” is to be established so as to prevent the leakage of these technologies to China, which could have potential national security implications down-the-line.

FIRRMA was written with a two-fold intertwined purpose in mind. First, to subject state-owned, state-funded or state-linked FDI transactions from “countries of special concern” that have a declared strategic goal of acquiring a type of critical technology that could undermine U.S. leadership in areas related to national security to qualitatively greater scrutiny. The self-sufficiency goals in China’s Made in China 2025 industrial policy plan, foremost, come to mind in this regard. Second, to shut down gaps and loopholes within the CFIUS processes that could otherwise enable a foreign entity, particularly a state-owned or state-linked entity, to exploit minority position investments in early stage U.S. technology companies and gain access to cutting-edge intellectual property, trade secrets, and key personnel. These U.S.-bred capabilities could then be replicated on that country’s soil (China), undermining U.S. technological and military leadership in the future.

Section 1703 of Title XVII of the National Defense Authorization Act (NDAA) for Fiscal Year 2019 encapsulates these upgraded, de facto China-specific investment screening restrictions. The two key provisions of Section 1703 in this regard are:

The other important de facto China-relevant, investment transactions that are subject to additional CFIUS scrutiny, as per Section 1703, are:

Simultaneously, the NDAA creates a mechanism to identify and control the export of “emerging and foundational technologies.” A regular, on-going inter-agency process to identify such “emerging and foundational technologies” is to be created, and the existing Emerging Technology and Research Advisory Committee is to be tasked with preventing the leakage of such technologies by identifying efforts by foreign governments and entities to circumvent these export controls. Emerging and foundational technologies identified and export-controlled within the inter-agency mechanism are to be henceforth considered “critical technologies” under the CFIUS regime and, transactions in this regard, subjected to exhaustive review.

Section 1703 defines “substantive decision-making” capability as membership or observer rights on the board of directors or equivalent governing body of the prospective U.S. business or the right to nominate an individual to a position on that board of directors or equivalent. “Material non-public technical information” refers to any information that provides knowledge, know-how or understanding that is not available in the public domain and is critical to the design, fabrication, development, testing, production or manufacture of a critical technologies or design and operation of critical infrastructure. “Substantial interest” refers to any means by which a foreign government (China) could influence the actions of the prospective foreign entity that seeks to merge, acquire, takeover or otherwise invest in a U.S. business, including through board membership, ownership interest, or shareholder rights in that foreign entity. A foreign government’s (China) voting interest that is or exceeds 10 percent in the foreign acquiring entity’s shareholding structure is deemed to meet the definition of “substantial interest.” “Emerging and foundational technologies” is defined as technologies that are, or could be, essential to U.S. national security but not presently controlled.

There are a number of other mandatory China-specific reporting requirements as well. Starting in 2020, a report on Chinese investment trends in the U.S. is to be compiled, including the extent to which the pattern of investments aligns with Beijing’s ‘Made in China 2025’ industrial policy plan. A list of companies incorporated in the United States that have been purchased through Chinese government investment is to be notified too. Further, a report assessing the national security risk of investments by Chinese state-owned-or-controlled entities in the U.S. freight rail, public transportation rail systems or intercity passenger rail systems sectors is to be produced also by mid-2019.

The key innovation in FIRRMA is the closing of investment screening-related loopholes and the bringing-in of “critical technologies” within the CFIUS review net. In this regard, it is a worthy successor to FINSA, which at the time had drawn “critical infrastructure” fully within the CFIUS review net. How broadly or narrowly FIRRMA’s protective perimeter around “critical technologies” is drawn will depend on the how broadly or narrowly the ensuing FIRRMA-related regulations are written and interpreted. This having been said, FIRRMA will have a dampening effect on two-way U.S.-China investment and technology transfers. The best way for China to navigate the tightened CFIUS restrictions spelled out in FIRRMA is nevertheless to accelerate the liberalization of its foreign inward investment and foreign equity joint ventures regimes.

The Institute for China-America Studies is an independent nonprofit, nonpartisan research organization dedicated to strengthening the understanding of U.S.-China relations through expert analysis and practical policy solutions.

1919 M St. NW Suite 310,

Washington, DC 20036

icas@chinaus-icas.org

(202) 968-0595

© 2025 INSTITUTE FOR CHINA-AMERICA STUDIES. ALL RIGHTS RESERVED.

Trump’s Shipbuilding Ambition Risks Backfiring on His Big Deal