ICAS Bulletin (online ISSN 2836-3418, print ISSN 2836-340X) is published every other week throughout the year at 1919 M St NW, Suite 310, Washington, DC 20036.

The online version of ICAS Bulletin can be found at chinaus-icas.org/bulletins/.

– From April 5-9, U.S. Secretary of Treasury Janet Yellen traveled to China to visit American companies in the commercial and manufacturing hub of Guangzhou and then continue discussions with senior Chinese officials in Beijing for two more days.

– Although Secretary Yellen’s meetings addressed several topics during her trip—including trade imbalance, drug money laundry, green products—she regularly stressed before, during and after the trip the issue of overcapacity and the U.S. intent to defend its domestic markets from China’s excessive import. At one point Yellen advised China to “rethink” its economic growth strategy. Ahead of a meeting with Chinese Vice Premier He Lifeng and other officials, Yellen said the U.S. “seeks a healthy economic relationship with China that benefits both sides” and “a healthy relationship must provide a level playing field.”

– While meeting with Vice Minister He Lifeng, Yellen also warned Beijing of “significant consequences” if China’s companies, banks or exporters support Russia’s war, to which Beijing responded that “[w]e have never and will never seek gains from the crisis.”

– Aside from issues discussed, Americans and Chinese observers were again united in their curiosity about what Secretary Yellen would be eating in China, which Premier Li Qiang made note of in his opening remarks.

– At the end of her visit to China, Yellen concluded that U.S.-China relations is on “more stable footing” but can still be improved upon.

– Chinese leadership, who had shown a warm welcome to Secretary Yellen throughout her trip, said at a press briefing at the end of her trip that the “so-called ‘overcapacity’ is the manifestation of the market mechanism that plays its role” and that “imbalance is often the norm.”

Associated News References:

“Beijing Pushes Back on Overproduction Concerns After Yellen Visit,” The Wall Street Journal, April 9 [Paywall]

“China Says It Has Not, Will Not Seek to Gain From War in Ukraine,” Bloomberg, April 8 [Paywall]

“US will not accept Chinese imports decimating new industries, Yellen says,” Reuters, April 8

“Yellen Sees ‘More Work to Do’ as China Talks End With No Breakthrough,” The New York Times, April 8 [Paywall]

“Culinary diplomacy: The internet is obsessed with what Janet Yellen eats in China,” AP News, April 8

“Yellen calls for level playing field for US workers and firms during China visit,” ABC News, April 4

“Yellen says China’s rapid buildout of its green energy industry ‘distorts global prices’,” AP News, March 27

– According to two senior U.S. officials, U.S. President Joe Biden is set to warn China about its aggressive actions in the South China Sea during a trilateral summit in Washington, D.C. with Japanese Prime Minister Fumio Kishida and Philippine President Ferdinand Marcos Jr.

– After a nearly two-year break, U.S. and Chinese defense officials resumed talks to address unsafe and aggressive military incidents in the Pacific. The discussion, which took place April 3-4 in Hawaii, aimed to ease escalating tensions and improve communication.

– On April 4, China’s Vice-Minister of Commerce Wang Shouwen and Under Secretary Marisa Lago of the Department of Commerce led a working group meeting in Washington, D.C. to discuss regulatory transparency, tariffs, and market access, among other issues.

– On April 2, days ahead of two top U.S. diplomatic visits to China, U.S. and Chinese presidents Joe Biden and Xi Jinping held their first phone call since July 2022 during which they discussed a range of issues. In their call, presidents Biden and Xi addressed matters including Taiwan, fentanyl, advancements in AI, and “continued concerns about the PRC’s unfair trade policies.” This call aims to reestablish regular top-level exchanges between the United States and China.

– On March 27, President Xi Jinping met with top American businesspeople and academics in Beijing to reassure them about China’s market amidst ongoing tensions with the U.S., highlighting the health of China’s economy and its reliance on international cooperation.

Associated News References:

“Biden to Warn China on South China Sea, Report Claims,” The Diplomat, April 8

“US-Chinese military talks resume on safety in the air and at sea after a nearly 2-year break,” ABC News, April 5

“US raises commercial and market access issues with China in meeting,” Reuters, April 4

“Biden and Xi discuss Taiwan, AI and fentanyl in a push to return to regular leader talks,” AP News, April 2

“China’s Xi meets American CEOs in bid to boost confidence in ailing economy,” NBC News, March 27

– Newly released cyberthreat reports from Microsoft Corp. and the U.S. intelligence community highlight China’s rising capability of conducting cyber misinformation campaigns which include a potential disinformation operation conducted during the Taiwan presidential election in January 2024.

– In early April, the U.S. Cyber Safety Review Board (CSRB), authorized by President Joe Biden, criticized Microsoft Corp. for its “inadequate security culture” that allowed the Chinese hackers to breach emails in American companies and government officials.

– In late February, U.S. intelligence officials from the FBI, State Department and the Office of National Intelligence reported to about a dozen senators in a classified meeting how Chinese pharmaceutical firm WuXi AppTec had transferred U.S. company’s intellectual property to the Chinese government.

– Simultaneously, the U.S. Senate Committee on Homeland Security & Governmental Affairs is working on a bill that could prohibit foreign access to American biotech information on the grounds of national security.

– On March 25, the U.S. Department of Justice indicted Chinese hackers’s cyberattack on European Union members, though European Parliament officials insisted that “our lawmakers were not targeted.”

Associated News References:

“China Is Targeting U.S. Voters and Taiwan With AI-Powered Disinformation,” The Wall Street Journal, April 5 [Paywall]

“US government review faults Microsoft for ‘cascade’ of errors that allowed Chinese hackers to breach senior US officials’ emails,” CNN, April 2

“Exclusive: China’s WuXi AppTec shared US client’s data with Beijing, US intelligence officials told senators,” Reuters, March 28

“China targeted European lawmakers with cyberattacks, Washington says,” Politico, March 27

– The U.S. Commerce Department has officially awarded a USD$6.6 billion subsidy to Taiwan Semiconductor Manufacturing Co’s (TSMC) for establishing an advanced semiconductor production plant in Phoenix, Arizona. The award also includes up to USD$5 billion in low-interest government loans.

– Defense ministers of the United States, the United Kingdom and Australia said that they are considering adding Japan as a new member to AUKUS—the trilateral security partnership between the three countries for the Indo-Pacific region.

– Around the same time, warships and aircraft from Australia, Japan, the Philippines and the United States conducted another joint patrol in the South China Sea.

– Meanwhile, U.S. and EU officials expressed concerns about the future of the U.S.-EU Trade and Technology Council (TTC) given the upcoming U.S. election.

– The Biden administration is reportedly pressing the Netherlands to prohibit ASML from selling certain semiconductor manufacturing equipment to China.

– Leading U.S. companies in artificial intelligence are reportedly asking Taiwanese manufacturers to set up AI-related production plants in Mexico to “replace products imported from Asia.”

Associated News References:

“TSMC wins $6.6 bln US subsidy for Arizona chip production,” Reuters, April 8

“AUKUS partners eye adding ‘like-minded’ Japan to counter China,” Financial Review, April 8

“U.S., Japanese and Australian Warships Join Philippine Forces in South China Sea Patrol,” USNI News, April 7

“EU and US vow to team up against China, but can’t hide the cracks,” Politico, April 5

“Exclusive: Targeting Chinese chips, US to push Dutch on ASML service contracts,” Reuters, April 4

“U.S. Tech Giants Turn to Mexico to Make AI Gear, Spurning China,” The Wall Street Journal, March 30 [Paywall]

– Li Auto, known as Tesla’s closest rival in mainland China, announced plans to very soon launch a new, more economical electric vehicle (EV) model aimed at families.

– As Treasury Secretary Janet Yellen wraps up her visit to China with repeated mentions of “overcapacity” by China, China’s Minister of Commerce Wang Wentao began a trip to Europe with a roundtable meeting in Paris with many, including top BYD and CATL, to express Beijing’s support. Wang reiterated that “China’s electric vehicle companies rely on continuous technological innovation, perfect production and supply chain system and full market competition for rapid development, not relying on subsidies to gain competitive advantage.”

– China’s biggest EV maker BYD reported its sales fell by 43% in the first quarter compared to the fourth quarter of 2023, bringing its numbers again below that of Tesla’s.

– U.S.-based EV maker Tesla, facing a global slowdown in EV demand and increasing number of rivals, saw its biggest-ever quarterly sales miss, especially in China where much of its market has historically been located.

– Chinese smartphone maker Xiaomi is kicking off sales of its first electric vehicles with aggressively low pricing set at just under $30k in a market where Apple has failed.

Associated News References:

“China EV price war: Tesla rival Li Auto says cheapest model yet to ‘bring you happiness’, will launch next week,” Yahoo!Finance, April 9

“China commerce minister kickstarts Europe trip with Chinese EV firms meeting,” CNBC, April 7

“BYD hands back top EV seller title to Tesla after Q1 sales decline,” Reuters, April 2

“Tesla’s Shrinking China Market Share Compounds Global Woes,” Bloomberg, April 2 [Paywall]

“China’s latest EV is a ‘connected’ car from smartphone maker Xiaomi,” NBC News, March 28

“China Plays Tense Game of ‘Russian Roulette’ With U.S. Ally,” The Wall Street Journal, April 9 [Paywall]

“Netflix’s take on ‘3 Body Problem’ gets mixed reviews in China,” Radio Free Asia, April 6

“China’s Ambassador Outlines Ambitious Plan to Jumpstart Economy,” Newsweek, April 5

“U.S. to Crack Down on Trade ‘Loophole’ Used for China Apparel Shipments,” The Wall Street Journal, April 5 [Paywall]

“U.S. loses its spot to China as Southeast Asia’s most favored ally, survey shows,” CNBC, April 3

“Lawmakers propose sanctions on US index funds investing in China,” Financial Times, April 3 [Paywall]

“Senior US diplomat links AUKUS submarine pact to Taiwan,” Reuters, April 3

“Russia, China catching up to U.S. in space weaponry, new report finds,” Space News, April 2

“US senator urges Biden to review alleged Nippon Steel ties to China,” Reuters, April 2

“Radio Free Asia closes Hong Kong bureau, citing security law concerns,” NBC News, March 30

“US may soon unveil list of Chinese chip factories barred from receiving tech,” Reuters, March 28

April 9 hosted by International Relations Council & Partners

April 8 hosted by Wilson Center

April 4 hosted by China Institute

April 2 hosted by Foreign Policy

March 28 hosted by Center for Strategic & International Studies

April 11 hosted by Hudson Institute

April 12 hosted by Foreign Policy Research Institute

April 16 hosted by Wilson Center & U.S. Heartland China Association

April 17 hosted by Wilson Center

April 25 hosted by University of Minnesota China Center & Brookings Institute

Wednesday, April 10, 2024

9:30am – 10:30am EST

Virtual (Zoom)

Artificial Intelligence has emerged as an unlikely area of U.S.-China cooperation amid their race for supremacy in cutting-edge technologies. In November 2023, President Biden and President Xi agreed to establish a govt-to-govt mechanism to discuss AI at their summit in Woodside, California, and a US-China working group on AI is expected to hold talks later this spring. Alongside, American AI companies have engaged in discussions with Chinese AI experts, and leading scientists of both nations have jointly put out calls for tighter controls on the technology.

As the U.S.-China working group on AI convenes later this spring, what are the set of priority areas to be discussed? Have the parameters of their discussion been established? What are the areas of common interest that are drawing the two sides together? Do the U.S. and China share a common vision of the core ‘red lines’ that powerful AI systems should not cross? Do they trust their counterpart enough to limit their own capability voluntarily? Can the U.S.-China talks, along with their discussions with the EU, serve as a building block for a multilateral treaty, say, on the lines of the 1960s-era Nuclear Non-Proliferation Treaty? Furthermore, what is the particular Chinese interest in these talks? And where does AI sit within the larger scheme of China’s technological advancement aspirations? To listen to these and other answers and insights on pressing U.S.-China AI policy questions, tune in to the event on April 10th.

Thursday, April 18, 2024

10:00am – 11:30am EST

In-Person (Washington, DC) & Online (Zoom)

As science and technology continue to advance, the ocean, covering 71% of the Earth’s surface, is undeniably assuming an increasingly vital role for humanity. Consequently, nations are diligently pursuing their respective maritime interests, revealing both commonalities and distinctions. The United States and China, widely recognized as major powers in contemporary international politics and prominent maritime nations, are increasingly focusing their attention on global maritime domains.

How do the maritime policies of China and the United States differ in terms of strategic objectives and priorities? What are the primary areas of competition between China and the United States in global maritime affairs? How do the maritime disputes, such as those in the South China Sea, impact the overall relations between China and the United States? Are there any ongoing cooperative efforts between China and the United States in global maritime security or environmental protection? What role do international law and institutions play in shaping the interactions between China and the United States in global maritime relations? How do the military doctrines and strategies of China and the United States intersect or diverge in the maritime domain?

In her new book US-China Global Maritime Relations, Dr. Nong Hong explores the U.S.-China maritime relationship within the global context and investigates six key maritime regions: the South China Sea, the Northeast Asia waters, the Indian Ocean, the South Pacific Ocean, as well as the Arctic and Antarctic regions. Through detailed observations, this book offers a comprehensive exploration of these regions and their significance in shaping the dynamics between the two nations.

This event will feature the author of US-China Global Maritime Relations, who will discuss the evolution and execution of maritime strategies pursued by both the United States and China. Moreover, three panelists will provide their insights on this subject, representing perspectives from the United States, China, and a third-party viewpoint.

by Nong Hong

April 8, 2024

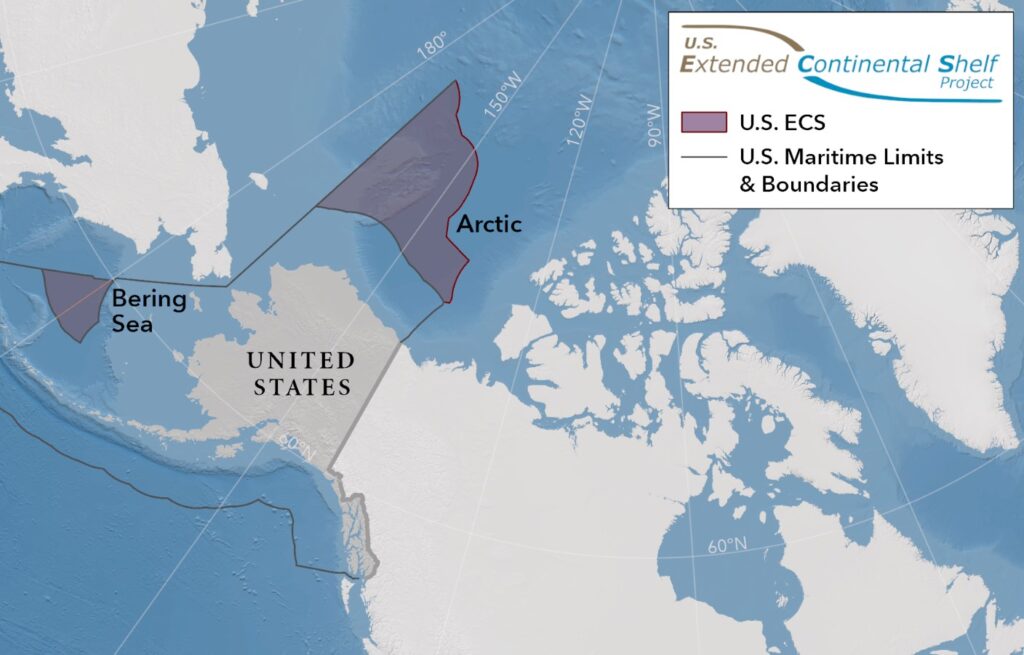

On December 19, 2023, the United States Department of State announced the outer limits of its continental shelf in areas beyond 200 nautical miles from the territorial sea baselines, or extended continental shelf (ECS), in various coastal regions including the Arctic, Atlantic (east coast), Bering Sea, Pacific (west coast), Mariana Islands, and two areas in the Gulf of Mexico. The ECS Task Force, chaired by the Department of State, oversees the delineation of these outer limits. The US Geological Survey (USGS) is responsible for collecting, processing, and interpreting seismic and geologic data, while the National Oceanic and Atmospheric Administration (NOAA) handles bathymetric data collection, processing, and analysis. This has sparked debates regarding whether the United States can bypass the Commission on the Limits of the Continental Shelf (CLCS) to proceed with the delineation of its continental shelf limits…

Blue Carbon & Climate Change 2024 Q1 Has Been Released!

The first week of April, the ICAS Blue Carbon & Climate Change Program released its BCCC Quarterly newsletter for 2024 Q1. This issue features a ‘Theme of the Quarter’ on “Renewable Energy Storage” and a ‘Blue Carbon Country Profile’ on ‘India.’

Released each quarter, the BCCC Quarterly records the most important trends and developments regarding blue carbon policies and regulations in China, the U.S., and other regions, as well as international regimes, such as under the United Nations framework. It also includes two special sections—the ‘Theme of the Quarter’ and the ‘Blue Carbon Country Profile’—that aim to bring a fresh and applicable element to each issue.

by Zhangchen Wang

March 29, 2024

As the lightest and most abundant element in the universe, hydrogen plays a crucial role across a wide range of applications. According to the U.S. Energy Information Administration (EIA), hydrogen serves various industrial purposes, including in the production of fertilizers, serving as a fuel in metal smelting and electricity generation, and functioning as a reactant or catalyst in the manufacture of various chemicals. For sustainable development purposes, the biggest significance and advantages of hydrogen include its roles as a clean energy source and an efficient energy storage carrier.

Nevertheless, according to 2021 data, the global production of hydrogen is still limited with only about 75 million tons per year. This level of production is sufficient just for existing industrial demands and falls short of making a significant impact in carbon reduction efforts…

On Friday, April 5, 2024, Senior Fellow Sourabh Gupta discussed the current global economic outlook on CGTN America’s The Heat.

On Monday, April 1, 2024, Senior Fellow Sourabh Gupta was quoted by China Daily on Chinese EVs and Treasury Secretary Yellen’s speech on excess capacity in China’s EV sector.

On Thursday, March 28, 2024, Senior Fellow Sourabh Gupta discussed China’s ties with the Global South on the occasion of the Boao Forum on CGTN’s The Point with Liu Xin.

The Institute for China-America Studies is an independent nonprofit, nonpartisan research organization dedicated to strengthening the understanding of U.S.-China relations through expert analysis and practical policy solutions.

1919 M St. NW Suite 310,

Washington, DC 20036

icas@chinaus-icas.org

(202) 968-0595

© 2024 INSTITUTE FOR CHINA-AMERICA STUDIES. ALL RIGHTS RESERVED.