Research Associate

Part-Time Research Assistant

Research Assistant Intern

In May 2023, the team at the Institute for China-America Studies (ICAS) launched the U.S.-China Legislative and Executive Actions Directory (L.E.A.D.) Project to track and summarize trending critical issues and developments on China, emanating from both the White House and Capitol Hill.

This is the fifth release of the Legislative Actions Directory and the second legislative release in 2024, summarizing recent U.S. legislative moves up to the October recess and with a special additional focus on the November congressional race.

As Congress resumed from its summer recess and as the election approaches, U.S. lawmakers in early September introduced a wave of China-related legislative measures, which in large part followed its consistent trajectory of firmly pushing for further U.S.-China strategic competition and decoupling. During what was dubbed as “China Week,” the House passed more than 20 bills targeting China, with a particular focus on emerging and critical technologies. Additionally, efforts were also made to address China’s global influence and to reassert democratic values related to U.S. concerns about China. Nevertheless, as the 118th Congress enters its final stretch, lawmakers face limited time to advance these measures, while the upcoming election promises to shift key players and hence potentially impact the overall legislative stance on China.

Between September 9 and 12, 2024, the House passed 27 bills during what it called “China Week,” 16 of which specifically addressed U.S.-China competition in critical technologies. These bills fell into three broad categories:

I. Direct Regulation of Critical Technologies

Among this first group of bills, much congressional effort was directed to denying or restricting the access of Chinese companies to U.S. biotechnology resources. Originally introduced by then China Committee Chair Rep. Mike Gallgher (R-WI) and ranking member Raja Krishnamoorthi (D-IL) on January 25, 2024, H.R. 7085 – BIOSECURE Act seeks to “ensure foreign adversary biotech companies…do not gain access to U.S. taxpayer dollars.” Specifically, the bill prohibits executive agencies and federal contractors from procuring or using biotechnology equipment and services provided by “biotechnology companies of concern” such as BGI, MGI, Complete Genomics, WuXi AppTec, WuXi Biologics, and other biotechnology companies that have concerning ties with the Chinese government. On agricultural biotechnology, H.R.9456 – Protecting American Agriculture from Foreign Adversaries Act requires the Committee on Foreign Investment in the United States—the existing regulatory process to review inbound foreign investment in the United States—to start reviewing transactions that involve agricultural land, agricultural biotechnology or the agricultural industry and include the Department of Agriculture in the review process. The bill constitutes a legislative advancement of Washington’s long-lasting concerns about Chinese companies’ purchase of U.S. farmland and investment in the U.S. agricultural sector, while explicitly underlining the relevance of agricultural biotechnology to the issue. On September 10, 2024, one day after Protecting American Agriculture from Foreign Adversaries Act passed the House, Senator Mike Braun (R-IN) and a bipartisan group of 16 Senator cosponsors introduced its Senate companion, S.5007. The bill is currently under discussion at the committee level in the Senate.

Telecommunications is once again coming under scrutiny too. This time, U.S. lawmakers are primarily focusing on cybersecurity risks—specifically, that the Chinese government might access sensitive U.S. data through China-made or China-linked telecommunications equipment. Most of the bills, however, have sought to gain more information about the scope of the risks and the U.S. government’s counter strategy. H.R.820 – Foreign Adversary Communications Transparency Act directs the Federal Communications Commission (FCC) to publish a list of companies that hold a FCC license or authorization but are owned by “foreign adversary” governments. H.R.7589 – ROUTERS Act requires the National Telecommunications and Information Administration to conduct a study of the national security risks posed by consumer routers and modems, keeping in mind the influence of China, Iran, North Korea and Russia. Internationally, H.R.4741 – Securing Global Telecommunications Act requires the Department of State to develop and submit to Congress a strategy to “promote the use of secure telecommunication infrastructure”—keeping in mind “efforts by China and Russia to advance authoritarian interests” in international telecommunications standards. The only bill that calls for strict policy denial measures is H.R.2864 – Countering CCP Drones Act. Citing concerns about the “drone monopoly” of Chinese company Da-Jiang Innovations (DJI) and the “economic and national security risks” that DJI drones pose when “operating on U.S. communications infrastructure,” the bill requires the FCC to ban certain DJI equipment and services, especially their new models.

Congressional attention also persisted on electric vehicles (EVs) and EV batteries, albeit with a narrower focus following the introduction of EV tariffs. Specifically, H.R.8631 – Decoupling from Foreign Adversarial Battery Dependence Act seeks to prohibit the Department of Homeland Security from procuring foreign-made batteries from CATL, BYD, Envision Energy, EVE Energy, Gotion High tech, Lithium Energy Storage Technology. Meanwhile, H.R. 7980 – End Chinese Dominance of Electric Vehicles in America Act would tighten certain regulatory loopholes to avoid Chinese business owners from acquiring U.S. tax credits by investing in American EV projects.

Noteworthily, the Senate is moving forward on the matter of critical minerals in the absence of House moves on this front. On September 18, 2024, S.1871 – Intergovernmental Critical Minerals Task Force Act passed the Senate by unanimous consent. Originally introduced by Senator Gary Peters (D-MI) on June 8, 2023 as part of a heated legislative debate on critical minerals in both chambers of Congress at the time, the bill requires the establishment of a task force within the Office of Management and Budget to determine how to address national security risks associated with the critical minerals supply chains and to identify new domestic opportunities for mining, processing, refinement, reuse, and recycling of critical minerals. The passage of the Intergovernmental Critical Minerals Task Force Act echoes prior Senate interest in the matter, including the introduction of S.5030 – National Critical Minerals Council Act by Senator John Kickenlooper (D-CO) on September 12, 2024. Meanwhile, the House Energy & Commerce Committee’s subcommittee on Environment, Manufacturing, and Critical Materials conducted a hearing on June 13, 2024 to examine U.S. economic and critical materials dependency on China, but there have not been subsequent actions forthcoming.

II. Expanding and Reforming U.S. Policy Tools

The second group of “China Week” bills were focused on strengthening U.S. policy tools, particularly in the area of export controls and sanctions.

In an effort to prevent China from “circumventing” U.S. export controls and acquiring American technology, H.R.8152 – Remote Access Security Act aims to broaden the scope of U.S. export controls to include remote access to technologies, services and items to address the “loophole” that certain Chinese companies could remotely access U.S. advanced semiconductor chips to train their artificial intelligence algorithms. Meanwhile, H.R.6606 would expand the policy objective of the U.S. export control system—which currently focuses on controlling the use of U.S. items for military and terrorist use or promoting U.S. foreign policy—to also include the protection of U.S. trade secrets.

Efforts to reform the system focus on both efficiency and transparency. H.R.7151 – Export Control Enforcement and Enhancement Act allows other federal agencies to propose modifications to the Entity List and requires the Department of Commerce to respond through an expedited process. H.R.6614 – Maintaining American Superiority by Improving Export Control Transparency Act requires the Department of Commerce to report to Congress on its licensing and enforcement actions regarding export controls in a detailed manner every 90 days.

Two other “China Week” bills focus on the reform of the sanctions framework to protect the U.S. economy. H.R.5613 – Sanctions Lists Harmonization Act seeks to increase interagency coordination on sanctions to prevent sanctioned Chinese companies from “engaging in the U.S. economy.” Specifically, the bill requires federal agencies in charge of maintaining a sanctions list to consider whether they should include entities already listed on other sanctions lists. Notably, days after the bill passed the House on September 9, 2024, U.S. Senators Marco Rubio (R-FL) and Jeff Merkley (D-OR) jointly introduced the bill’s Senate companion, S.5043, on September 12, 2024, making it the first “China week” bill with follow-up Senate movement. On another note, H.R.8361 – Economic Espionage Prevention Act authorizes the President to impose visa- and property blocking sanctions on “foreign adversary entities” that “knowingly engage in economic and industrial espionage,” provide material support to a foreign adversary’s national security entities, or violate U.S. export control laws.

III. Limiting Concerning Activities and Ties

A third group of “China Week” bills focused on limiting China’s access to U.S. technologies and curbing specific activities perceived as threats to national security. These measures aim to block certain collaborations, restrict academic engagements, and strengthen enforcement against intellectual property theft and espionage.

Notably, H.R.1398 – Protect America’s Innovation and Economic Security from CCP Act establishes a “CCP Initiative” within the Department of Justice to counter threats to the United States; curb spying on U.S. intellectual property and academic institutions; prosecute individuals engaged in trade secret theft, hacking and economic espionage; and protect U.S. critical infrastructure from foreign threats, among others. Meanwhile, S.2894 / H.R. 5245 – Science and Technology Agreement Enhanced Congressional Notification Act requires the Department of State to notify Congress at least 30 days in advance of entering, renewing, or extending any science and technology agreement with China. H.R.7686 seeks to clarify that researchers receiving CHIPS and Science Act fundings are prohibited from any “talent programs” funded by a foreign country of concern. And H.R.1516 – DHS Restrictions on Confucius Institutes and Chinese Entities of Concern Act prohibits the Department of Homeland Security from funding institutions of higher education that have a relationship with China’s Confucius Institutes.

Beyond technology, Congress also advanced several measures aimed at countering China’s influence on the global stage, as concerns continue to grow on Capitol Hill over China’s expanding presence in international institutions and key regions. The most significant bill in this regard, H.R.1157 – Countering the PRC Malign Influence Fund Authorization Act, would authorize $325 million through 2027 to “counter” China’s “malign influence”—i.e., efforts to “undermine a free and open international order,” to “advance an alternative, repressive international order” in China’s interests, or to otherwise undermine the national security and economic security of U.S., allies, partners and other countries. Rep. Andy Barr (R-KY), the sponsor of the bill, observed that the funds aim to address concerns such as “CCP disinformation,” “coercive economic practices like those tied to China’s Belt and Road Initiative,” “corruption,” and “transparency.” Under the current version of the bill, the Department of State will be responsible for identifying the strategic priorities for the usage of the funds, subject to required consultation with Congress. The bill was introduced on February 24, 2023 and passed the House on September 9, 2024 as part of the “China Week” bills.

Aside from the overarching Countering the PRC Malign Influence Fund Authorization Act, several bills emphasize the importance of U.S. engagement in specific regions where China’s influence is growing. Specifically, H.R.7159 – Pacific Partnership Act, a “China Week” bill that passed the House on September 9, 2024, requires increased U.S. engagement with the Pacific Island region and requires the President to periodically report to Congress the administration’s strategy for Pacific partnerships. H.Res.1056, another “China Week” bill that passed the House, recognizes “the importance of trilateral cooperation among the United States, Japan, and South Korea” as a matter of congressional sense of policy priority, and “welcomes ever greater levels of trilateral strategic coordination…as a stabilizing influence on the Western Pacific region and global order more broadly.” Attention was also paid to China’s practices in the South China Sea, as both House and Senate lawmakers introduced resolutions to condemn China’s “aggression” in the region, reaffirmed U.S.-Philippines defense ties and reaffirmed Philippines’ claim over the Second Thomas Shoal.

Congress also sought to limit China’s sway within key multilateral bodies. H.R. 510 – Chinese Currency Accountability Act “prevents the CCP from co-opting critical international institutions like the International Monetary Fund” by requiring the United States to oppose an increase in the weight of the Chinese Renminbi in the Special Drawing Rights basket of the Fund. Meanwhile, citing concerns of China’s influence within the World Health Organization (WHO), H.R.1425 – No WHO Pandemic Preparedness Treaty Without Senate Approval Act “clarifies” that any agreement originating from within the WHO framework is to be deemed a treaty that requires Senate approval before any U.S. commitment could come into effect.

With the 118th Congress reaching the final months of its term, U.S. lawmakers are placing renewed emphasis on democratic values, particularly regarding the issues of Taiwan, Hong Kong, Tibet and Xinjiang. Although economic and financial motives are mentioned as the cause of U.S. concerns, the legislative measures persistently and clearly underline the importance of democratic values over any economic or even security considerations. For example, H.R.554 – Taiwan Conflict Deterrence Act, the only “China Week” bill that primarily addresses Taiwan, seeks to “expose the financial corruption of China’s top leaders and their families,” “if China takes hostile military action against Taiwan.” Accordingly, the bill prepares for and authorizes financial sanctions against China’s leaders and their families in the case of a Taiwan contingency. Similarly, S.490 / H.R.1103, another “China Week” bill, requires the U.S. President to remove “certain privileges” accorded to the Hong Kong Economic and Trade Offices, “if Hong Kong no longer enjoys a high degree of autonomy from the People’s Republic of China.”

The most noteworthy of these bills is S.138 / H.R. 533 – Promoting a Resolution to the Tibet-China Conflict Act, which President Biden signed into law on July 12, 2024. The bill lists a number of congressional findings, statements of U.S. policy, and a “Sense of Congress” resolution to “enhance U.S. support for Tibet.” Notably, the bill declares that it is U.S. policy that “the Tibetan people have [the] right to self-determination” and establishes the position of a “United States Special Coordinator for Tibetan Issues” at the Department of State to counter China’s “disinformation about Tibet,” including “disinformation about the history of Tibet, the Tibetan people, and Tibetan institutions,…[and] of the Dalai Lama.” The bill was originally introduced on January 26, 2023 in the House and on January 30, 2023 in the Senate. It passed the Senate unanimously on May 30, 2024, subsequently passed the House on June 12, 2024, and was signed into law on July 12, 2024. On June 14, 2024, two days after the passage of its final version, a group of House lawmakers and supporters announced that they would form a bipartisan congressional delegation to meet with the 14th Dalai Lama, Tibetan religious-cum-political head and an exiled political figure. The delegation traveled to India on June 18, 2024 to meet the Dalai Lama.

From January 1 to September 24, 2024, six bills were introduced to address Uyghur-related concerns, including four that specifically speak to forced labor concerns. Including the Promoting a Resolution to the Tibet-China Conflict Act, three bills reiterated and expanded U.S. support on the Tibet issue; two addressed China’s repatriation of North Koreans; and 14 other bills expressed distinct value-based concerns such as China’s indirect involvement with child and forced labor in the Democratic Republic of Congo, Hong Kong’s national security laws, “wealth and corrupt activities of the leadership of the Chinese Communist Party,” “forced organ harvesting,” and remembrance of the “Tiananmen Square massacre,” among others. Congressional hearings have echoed similar themes. The House China Committee held a hearing on July 16, 2024 to address China’s “export of its techno-authoritarian surveillance state” and another on September 19, 2024 on “How the CCP Uses the Law to Silence Critics and Enforce its Rule.”

Beyond bills that directly target China, references to China continued to shape the 118th Congress’ penultimate legislative and policy discussions, even when the connection was less direct. China remains a convenient and frequent justification for policy proposals across a range of issue areas, from energy to taxation.

For example, S.1111 – Accelerating Deployment of Versatile, Advanced Nuclear for Clean Energy Act (ADVANCE Act), which has already become law, contains a policy objective to “reestablish U.S. historic global leadership in nuclear energy to counter Russia and China,” but includes only limited content that impacts or relates to China. Instead, the bill introduces a number of domestic policies to support the U.S. civil nuclear industry, strengthen the U.S. nuclear fuel cycle and supply chain infrastructure, and increase general efficiency of the relevant regulatory bodies. The bill also strengthens the U.S. government’s ability to lead in international coordination and regulation related to the development of advanced nuclear reactors. Emerging from a series of legislative discussions on building U.S. civil nuclear leadership against Russia and China since at least early-2023, S.1111 passed the House as part of S.870—a package bill combining the ADVANCE Act and the Fire Grants and Safety Act—on May 8, 2024 and passed the Senate on June 18, 2024. The bill was signed into law on July 9, 2024.

Congressional political campaigns have also increasingly invoked China of late as a talking point. For example, in promoting the benefits of Trump-era tax cuts, a August 20, 2024 House Ways & Means Committee statement argues that the “Biden-Harris tax and spend agenda” handed “special interest tax breaks to the wealthy, well-connected, big banks, billion-dollar companies, and China” and that American businesses used to pay a higher corporate tax rate “than even that of Communist China” before the Trump tax cuts. On August 14, 2024, in lauding the positive impacts of the CHIPS and Science Act for the state of Virginia, Sens. Mark R. Warner (D-VA) and Tim Kaine (D-VA) argued that the CHIPS and Science funding “will allow the U.S. to keep pace with China and other competitors” in science and technology. Both Republican and Democratic candidates have escalated their anti-China rhetoric on their campaign trails. Candidates also frequently accused their opponents of having ties to China or not being tough enough on China, reinforcing the bipartisan consensus that sees China as a strategic competitor, or, to put it plainly, as an adversary.

While U.S. policies toward China have remained relatively stable over the past four months, significant shifts in the political landscape—marked by personnel changes in Congress and the White House—are poised to influence future China policy. Vice President Kamala Harris’ emergence as the Democratic presidential candidate, replacing incumbent President Joe Biden, has shaken up the race. Current polling places Harris ahead of Republican candidate Donald Trump by a margin of 49.8% to 46.5%. In key swing states, Harris holds leads in Georgia, Michigan, and Nevada, while Trump leads in Arizona, North Carolina, and Wisconsin.

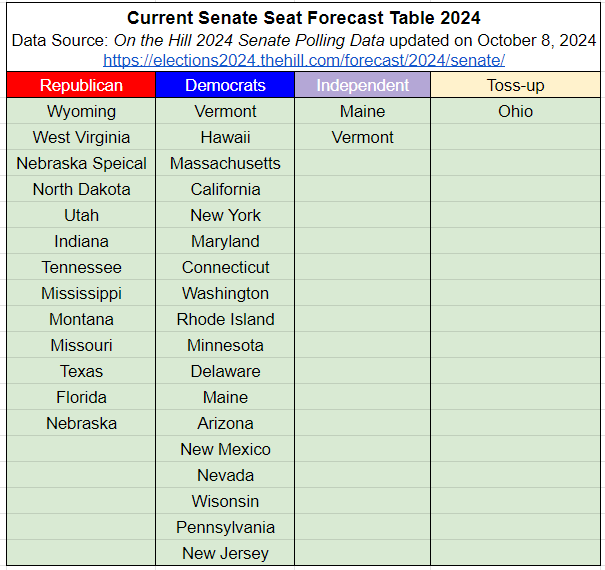

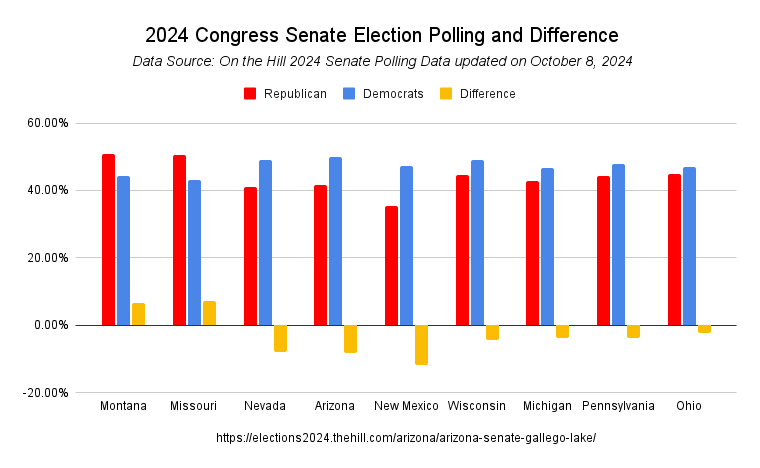

The upcoming Senate elections too are pivotal for shaping the U.S.’ China policy. With 34 of the 100 Senate seats up for election, control of the Senate hangs in the balance. Even in the case of a Harris presidency, Democrats will need to secure at least 49 seats to maintain a majority, while Republicans require 51. Recent polls indicate that the Democrats lead in 20 of the contested seats, and Republicans lead in 13, giving the GOP a potential advantage, especially since they currently hold 38 out of the remaining 66 seats. 8 of 9 swing states’ seats show a clear tendency in terms of party lead in the polling data. Democrats have a high possibility of winning the Senate seats in Nevada, Arizona, New Mexico, Wisconsin, Michigan, and also Pennsylvania. Republicans lead in Montana and Missouri. The only swing seat that does not show an overwhelming lead for either side is the one in Ohio. That said, overall, if voting results are consistent with the polls, Republicans stand to win the majority. To avoid such a consequence, Democratic candidates need to ramp-up their support numbers in Montana and Ohio, two swing states, where they might have some chance to reverse the Republicans’ lead.

However, the Democrats face fierce competition in these states. In Montana, Senator Jon Tester (D-MT) is one of the most vulnerable Democratic incumbents. He trails Republican candidate Tim Sheehy, who enjoys a 50.9% support rate compared to Tester’s 44.2%. Trump’s strong support in Montana has bolstered Sheehy’s election campaign. In Ohio, Senator Sherrod Brown (D-OH) faces an uphill battle for re-election in a state leaning toward Trump. Brown’s Republican opponent, Bernie Moreno, currently polls at 44.8% compared to Brown’s 47%. However, Trump’s nomination of J.D. Vance as his vice-presidential pick has complicated the race, as Vance’s strong ties in Ohio could erode Brown’s support. This situation has forced Democrats to strategically allocate resources between Harris’s presidential campaign and securing a Senate majority.

Changes in Senate committee leadership are also set to impact future China policy. Senator Sherrod Brown’s re-election campaign is critical due to his role as Chairman of the Senate Banking, Housing, and Urban Affairs Committee. In 2023, Brown consistently pursued an agenda focused on addressing concerns over China’s “unfair trade practices,” introducing bills such as S.805, the Fighting Trade Cheats Act of 2024, and S.1856, the Leveling the Playing Field 2.0 Act, both aimed at strengthening U.S. trade law enforcement.

The resignation of Senator Bob Menendez (D-NJ), former Chair of the Senate Foreign Relations Committee, has created a significant shift too. Menendez had been influential in shaping China-related policy, advocating for Congress to be an “active partner” in U.S. diplomacy in the Indo-Pacific and introducing legislation like the S.958 – American Economic Diplomacy Act, the S.1457 – Taiwan Tax Agreement Act of 2023, and the S.Res.273 – A resolution promoting stronger economic relations between the United States, Canada, and countries in Latin America and the Caribbean. However, in July 2024, Sen. Menendez’s indictment on corruption charges led to his relinquishment of the Senate Foreign Affairs Committee chair.

Senator Joe Manchin’s (I-WV) retirement, meanwhile, adds another layer of complexity. As Chairman of the Committee on Energy and Natural Resources, Manchin influenced U.S. energy policy related to China, especially given the ongoing debate between Democrats and Republicans over renewable energy. A key supporter of the Inflation Reduction Act, he helped advance the climate change agenda in 2022 with Sen. Chuck Schumer (D-NY) and continued in this vein by introducing energy-related bills including S.1928 – Civil Nuclear Export Act of 2023 and S.826 – International Nuclear Energy Act of 2023. Other than on the energy issue, in early 2023, Sen. Manchin as the chair of the Senate Cybersecurity subcommittee joined a group of 12 senators sponsoring S.686 – Restricting the Emergence of Security Threats that Risk Information and Communications Technology (RESTRICT) Act, which takes TikTok to task. His departure not only affects energy policy but also shifts West Virginia firmly into the Republican camp, with local support coalescing around Republican Governor Jim Justice.

In Pennsylvania, Senator Robert P. Casey (D-PA) faces stiff competition from Dave McCormick, a former Undersecretary of the Treasury for International Affairs under President George W. Bush. Casey has previously pushed for legislation like S.4369 – Secure Smartports Act of 2024, and the 2023 NDAA amendment on Outbound Investment Transparency, both aimed at increasing transparency with regard to U.S.-China trade relations. McCormick’s tenure as CEO of Bridgewater Associates, which raised significant funds for investment in China, has drawn criticism from Casey, particularly regarding investments linked to Chinese fentanyl producers.

The retirements of Senators Debbie Stabenow (D-MI) and Thomas R. Carper (D-DE) will also leave vacancies in key committees—Agriculture, Nutrition, and Forestry Committee, and Environment and Public Works Committee, respectively. Additionally, Senator Mitt Romney’s (R-UT) retirement sees Representative John Curtis (R-UT) leading in local polls as his likely successor.

The Republican control of the Senate, while somewhat assured, faces internal uncertainties. With Senator Mitch McConnell stepping down as Majority Leader, the leadership role is being contested by Senators John Cornyn (R-TX), John Thune (R-SD), Rick Scott (R-FL), and Mike Lee (R-UT). This leadership transition will influence the party’s direction on China policy and related critical issues. Yet, probably but not likely, the capture of the Senate is still not a given due to certain unprecedented changes in deep Republican states such as Texas.

Control of the House remains uncertain too. Democrats currently lead in 210 districts while Republicans lead in 215, with 10 seats classified as toss-ups. Republicans have a slightly easier path to a majority, needing to win only three more seats, while Democrats need to secure eight. However, variable factors such as individual defections and campaign financing could tip the scales. For example, Representative Tony Gonzales (R-TX) has expressed frustration with his party and has supported Democratic agendas on issues like gun safety and same-sex marriage protections. Moreover, financial funding is another variable that could change the complexion of the House races. On September 3, it was disclosed that there is a substantial funding gap between Democrats and Republicans. The leader of House Republicans admitted that he needed $35 million more to compete in these races. On the other hand, the Democrats seem flush with campaign money. As such, any one of these variables could impact the final outcome.

Regarding leadership changes, there have been many in the House. After multiple terms as Speaker and Minority Leader, Representative Nancy Pelosi stepped down from her leadership position, with Representative Hakeem Jeffries (D-NY) succeeding her. Though Jeffries has been quieter on China issues, his new role positions him in a big way to shape the party’s policy priorities on China. On the Republican side, the leadership upheaval continues with Speaker Mike Johnson (R-LA) facing disunity within his ranks.

Another key leadership change in the House is the stepping down of Rep. Bob Goods (R-VA) as the chairman of Freedom Caucus. Rep. Goods was the sponsor of H.R.7950 – Iran China Accountability Act of 2024 and H.R. 551 – No Taxpayer funding for the Chinese Communist Party Act of 2023. With Representative Andy Biggs (R-AZ) withdrawing from consideration, Representative Andy Harris (R-MD) is set to lead the Freedom Caucus. He was previously responsible for introducing funding bills, such as H.R.9027 – Agriculture, Rural Development, Food and Drug Administration, and Related Agencies Appropriations Act, 2025, for the Department of Agriculture and Food and Drug Administration.

Finally, the somewhat sudden resignation of Representative Mike Gallagher (R-WI), Chair of the House Committee on China, leaves a key void. His successor, Representative John Moolenaar (R-MI), though, has already introduced notable China-related bills, including H.R.5926 – Exposing China’s Belt and Road Investment in America Act of 2023 and H.R.8636 – Foreign Investment Transparency and Accountability Act.

With the 2024 general election barely four weeks out, much will hinge on the final complexion of the Senate and the House. Recent shifts in congressional leadership and the evolving political landscape underscore a pivotal moment for U.S.-China relations. With Vice President Kamala Harris emerging as a strong Democratic presidential contender, the balance of power on the Hill will be a key element of the United States’ future China policy. The retirement of senior and influential Congressional leaders is adding a twist to this finely-tuned power balance. The future of U.S.-China relations will be shaped by these unfolding political dynamics and leadership changes.

The Institute for China-America Studies is an independent nonprofit, nonpartisan research organization dedicated to strengthening the understanding of U.S.-China relations through expert analysis and practical policy solutions.

1919 M St. NW Suite 310,

Washington, DC 20036

icas@chinaus-icas.org

(202) 968-0595

© 2025 INSTITUTE FOR CHINA-AMERICA STUDIES. ALL RIGHTS RESERVED.

Opinion | As China modernises its navy, the US races to stay ahead