L.E.A.D. Legislative Brief

WASHINGTON, DC – JULY 14: U.S. Speaker of the House Kevin McCarthy (R-CA) speaks to reporters during a news conference after the passage of the National Defense Authorization Act (NDAA) at the U.S. Capitol Building on July 14, 2023 in Washington, DC. (Photo by Anna Moneymaker/Getty Images)

Congress Refining and Zooming in on Critical Issues

- Economics & Trade, Global Politics, Security, US Domestic Politics

- China, Global, U.S.

ISSUE BRIEF BY:

Research Associate

Part-Time Research Assistant

In May 2023, the team at the Institute for China-America Studies (ICAS) launched the U.S.-China Legislative and Executive Actions Directory (L.E.A.D.) Project to track and summarize trending critical issues and developments on China, emanating from both the White House and Capitol Hill.

This is the second release of the Legislative Actions Directory.

On This Page

Following the first four months of the 118th Congress, where lawmakers broadly explored and discussed a wide range of issues that could advance Washington’s strategic objective to outcompete China, lawmakers moved on during the May to August, 2023 period to refine the approach and laser-focus on critical issues. Compared to January to April, 2023, a significantly larger proportion of China-related bills, hearings and statements over the last four months (May to August) addressed critical and concrete challenges that are widely recognized in Washington. In particular, considerable advancement is observed in legislative measures on outbound investment controls, the critical minerals supply chain, and the expansion of U.S. trade remedy laws. Meanwhile, traditional and non-conventional national security concerns as well as the issue of Taiwan remain as hot topics in legislative deliberations related to China.

By the end of August, the 118th U.S. Congress introduced 276 bills that address China or China-related issues. While many of them still remain in the realm of highlighting issues of concern related to China, unlike at the beginning of the year, many of the bills are now more focused on addressing or solving the issues rather than just voicing a sense of grievance. Ideological differences and COVID-19 conspiracies still remain in the legislative discussion but are quickly being superseded by more professionally guided policy discussions that address the specifics of U.S.-China strategic competition. However, this also shows the 118th Congress’ determination to formalize and facilitate U.S.-China competition, regardless of where the political wind might be blowing.

Outbound Investment Controls

1. Outbound investment controls take the first critical step(s).

One of the major achievements of Congress during the May to August, 2023 period was the formation of a bilateral consensus to support the White House’s establishment of an outbound investment controls mechanism, by way of an executive order. Moreover, the interplay between the Biden administration and Congress during this period set up a precedent for future interaction between executive and legislative branch, especially as Congress builds on the executive order and, down the line, writes a comprehensive outbound investment controls mechanism into law.

With open support from top lawmakers and continuing efforts by its key proponents, the push to establish an outbound investment controls mechanism gained considerable momentum on the hill during the past four months. On May 3, 2023, Senate Majority Leader Chuck Schumer announced a new “China Competition Bill 2.0” initiative with five key focus areas, the second of which is “curtailing the flow of investment to the Chinese government” through screening U.S. investments that go to Chinese companies in “certain key sectors.” Neither Leader Schumer nor the Senate committee chairs supporting the initiative specified what “certain key sectors” mean or might contain. In the House, open statements in support of outbound investment screening had occurred earlier. On February 7, 2023, House Appropriations Committee ranking member Rep. Rosa Delauro and Foreign Affairs Committee Chair Michael McCaul co-authored an op-ed in The Washington Times to advocate for a “whole-of-government” screening mechanism of select outbound investments to China. On May 9, 2023, shortly after Leader Schumer’s release of the “China Competition Bill 2.0” initiative, a bipartisan group of house lawmakers—including Rep. Rosa Delauro and Ways & Means Committee members Brian Fitzpatrick and Bill Pascrell—re-introduced the National Critical Capabilities Defense Act of 2023 (NCCDA). The bill proposes an interagency committee to broadly oversee, investigate and screen U.S. outbound investment in select countries and in a defined list of critical industries as well as to mitigate “supply chain outsourcing.” In mid-July, Senate Finance Committee members Bob Casey and John Cornyn circulated and proposed the Outbound Investment Transparency Act. A significantly milder version than the House’s NCCDA, the Senate bill requires only notification in advance of joint venture, greenfield investments and ‘know-how’ transfers in select critical industries. The Outbound Investment Transparency Act passed the Senate on July 25, 2023 as part of the the National Defense Authorization Act for Fiscal Year 2024 (FY24 NDAA). There appears to be no reported opposition in the House against the bill’s inclusion in the final NDAA. Meanwhile, NCCDA, the more expansive House bill, was denied consideration by the House Rules Committee from being included in FY24 NDAA.

Although Congress seems to agree that some outbound investment controls should be established, the difference between the House’s NCCDA and the Senate’s Outbound Investment Transparency Act demonstrate a pronounced divergence over the exact scope and outlook of such a mechanism—or, at least, over what the first steps in legislative action should look like. A revised version of the National Critical Capabilities Defense Act of 2022 of the last Congress, the House’s National Critical Capabilities Defense Act of 2023 proposes to establish an interagency committee led by the Executive Office of the President to broadly oversee, investigate and review select outbound investment. U.S. companies are required to report their outbound investment in China, Russia, Iran, North Korea, Cuba and Venezuela if they operate in critical industries such as semiconductors, artificial intelligence (AI), quantum computing, large capacity batteries, critical minerals and materials, active pharmaceutical ingredients (API) and automobile manufacturing. Meanwhile, the committee is authorized to mitigate or prohibit outbound investment that pose a risk to national security, or mitigate “supply chain outsourcing,” e.g. by increasing support to the domestic industry. In comparison, the Senate’s Outbound Investment Transparency Act takes a much more limited approach to require only notifications for certain outbound investment. As “a strong first step to give the U.S. insight into the risks of allowing American national security technology and know-how get into the hands of our adversaries,” the bill would require U.S. firms to notify the Treasury Department in advance of joint venture, greenfield investments and ‘know-how’ transfers in sectors including advanced semiconductors and microelectronics, artificial intelligence, quantum information science and technology, hypersonics, satellite-based communications and networked laser scanning systems with dual-use applications. Reps. DeLauro and Pascrell expressed “appreciation” for Senators Casey and Cornyn’s work to “ensure we got our foot in the door,” but said they “continue to believe that comprehensive review, rather than just notification, is the preferable approach to developing an outbound investment mechanism.” Senators Casey and Cornyn were lead proponents of the National Critical Capabilities Defense Act of 2022 in the last Congress. It is unclear whether they would continue to push for an interagency review and screening model during this Congress.

Meanwhile, Republican lawmakers on the House Financial Services Committee remain concerned about the impacts of certain restrictions on U.S. outbound investments. Following “rumors” that the Treasury Department might plan to “transform CFIUS into a committee on foreign investment in the United States and China,” House Financial Services Committee Chair Patrick McHenry cautioned that such a mechanism would “prove futile in its intended effect and further serve the Chinese Communist Party’s goal of limiting the influence of Western firms in Chinese markets.” As is shown in later documents, the House Financial Services Committee also expressed concern about “the risks of undermining bedrock American principles, including the free flow of capital” and supported a “more thoughtful and targeted approach” accompanied with efforts to “export our rule of law and property rights.”

As legislative deliberations continue, Democratic lawmakers have called on the Biden administration to take immediate action and, using executive authority, start mitigating the relevant risks. On August 9, 2023, U.S. President Joe Biden issued the Executive Order on Addressing United States Investments in Certain National Security Technologies and Products in Countries of Concern. The EO identifies as a national emergency that “countries of concern are exploiting or have the ability to exploit certain United States outbound investments,” including the intangible benefits and know-how transfers accompanying these investments, to develop “sensitive technologies and products critical for the military, intelligence, surveillance, or cyber-enabled capabilities.” To address this national emergency, the Secretary of the Treasury is tasked to introduce regulations that would require U.S. companies to report certain outbound investments and prohibit certain other outbound investments. Although the Treasury Department is still seeking public comments and has only released an advance notice of proposed rulemaking (ANPRM), the executive order is generally perceived to have a narrow, targeted focus on dual use or sensitive technologies in the areas of semiconductors, quantum information technologies and artificial intelligence—the three sectors that the executive order explicitly named in describing the national emergency it seeks to address.

Most lawmakers embraced the executive order as a welcome step to restrict certain outbound investments, and signaled the importance and necessity of more legislative actions on the issue, including by ensuring the passage of the Outbound Investment Transparency Act. On August 9, 2023, the day President Biden signed the executive order on outbound investment, Senator Bob Casey, the co-sponsor of the Outbound Investment Transparency Act, argued that Congress now needs to step up and “pass strong bipartisan legislation to protect our national and economic security for decades to come.” As stated before, the Outbound Investment Transparency Act would require U.S. firms to notify the Treasury of certain investments in a range of cutting-edge technologies. The bill passed the Senate on July 25, 2023 as part of the Senate’s version of FY24 NDAA. It is seen as the most likely next-step on outbound investment controls following the executive order.

Meanwhile, other lawmakers reacted to the executive order by calling for an expansion of outbound investment controls over more sectors and/or more types of investments. After welcoming the executive order as a timely new measure that would help limit U.S. investments in China, House Foreign Affairs Committee Chairman Michael McCaul criticized the Biden administration’s “failure to include existing technology investments as well as sectors like biotechnology and energy” and called for “aggressive action” that is “needed more than ever.” House China Committee Chair Mike Gallagher similarly acknowledged the executive order as “a small step in the right direction” that nevertheless fails to address wide “loopholes” such as “the passive flows of U.S. money into malign CCP-affiliated companies.” As of end-August 2023, neither lawmaker had proposed any standalone outbound investment bill in accordance with their respective statements.

Furthermore, the increasing attention on outbound investment controls in “critical technologies” reflect wider policy concerns about national security risks posed by cutting-edge technologies. For example, the Intelligence Authorization Act for Fiscal Year 2024, which the Senate included in its version of the NDAA on July 27, 2023, specifically seeks to increase the oversight of “national security threats posed by People’s Republic of China” through “investments in, and attempts to dominate, the supply chains of artificial intelligence (AI), next-generation energy technologies, and biotechnology,” among others.

Supply Chain and Competitiveness

2. Continuing efforts to boost American competitiveness are highlighted by critical minerals supply chain resilience measures.

Guided by the notion of strategic competition with China, efforts to boost American competitiveness dominated the policy discussions of American lawmakers during the Summer of 2023. American lawmakers aimed to address the issue from two angles: to redirect global investment away from China, and to reduce America’s reliance on China. This period was highlighted by legislation and discussion seeking to attract foreign investment and to further delink America from China’s supply chain networks, especially with regard to critical minerals.

During the May to August, 2023 period, lawmakers continued the quest to enhance U.S. economic competitiveness, beating in mind foremost the strategic competition with China. For example, H.R.813 Global Investment in American Jobs Act of 2023 seeks to “enhance America’s competitiveness for foreign direct investment—particularly in emerging technologies—by helping to reduce investment barriers while protecting against challenges posed by state-owned or backed enterprises, like those originating in China.” The bill would direct an interagency review to determine U.S. competitiveness in attracting foreign investment, make recommendations on how to best reduce bureaucratic barriers to further investment, mark down trends in global cross-border investment and data flows for information transfer between countries, and identify challenges posed by “state-owned entities and the impact of their protectionist policies.” The bill was proposed by Rep. Greg Pence on May 4, 2023, and passed the House on July 17, 2023.

There has also been a more pronounced and targeted focus on fixing vulnerabilities in U.S. supply chains, particularly on critical minerals, with these efforts roughly coinciding with administrative actions. For example, on February 28, 2023, President Biden signed a presidential waiver to provide the Department of Defense (DoD) more authority under the Defense Production Act to strengthen U.S. supply chains, including on the mining and processing of critical minerals. On June 15, 2023, Senator Mitt Romney introduced S.2031 Critical Mineral Independence Act, which would require the DoD to submit a strategy on how to reduce DoD reliance on mining or processing of critical minerals in China or by Chinese entities, including by utilizing authorities under the Defense Production Act. Legislative actions also coincided with administrative initiatives on broader efforts to increase domestic capabilities related to critical minerals. On April 26, 2023, Rep. Tony Gonzales introduced H.R.2888 ONSHORE Manufacturing Act of 2023 to create a financial investment program to strengthen rare earth manufacturing capabilities in the U.S. On June 8, 2023, Senator Gary Peters introduced S.1871 Intergovernmental Critical Minerals Task Force Act to create an interagency task force to coordinate actions and design recommendations to strengthen U.S. domestic capabilities for mining, processing, refinement, reuse, and recycling of critical minerals. Several months later, on August 21, 2023, the U.S. Department of Energy announced up to $30 million to support the onshore production of rare earths and other critical minerals.

The various bills introduced in the past four months interestingly reveal a legislative divide over critical minerals sourced from the Democratic Republic of Congo (DRC). DRC is known to have rich critical minerals resources, including cobalt, copper and lithium. On December 13, 2022, U.S. Secretary of State Anthony Blinken announced that the United States had agreed to a memorandum of understanding (MOU) with the DRC and Zambia to develop an electric vehicle battery supply chain, drawing legislative attention to the issue of critical minerals supply chain collaboration between the U.S. and DRC. Lawmakers proposed varied responses to the MOU and further collaboration opportunities. H.R.4443, introduced by Rep. Christopher Smith on June 30, 2023, would bar the importation of “all goods containing cobalt, lithium and other rare earth minerals mined in the Democratic Republic of Congo (DRC) through child exploitation and forced labor trafficking and also to counter China’s control of strategic metals and minerals in the global supply chain.” By contrast, H.R.4548 BRIDGE to DRC Act of 2023, introduced on July 12, 2023, would create a national strategy “to secure United States supply chains involving critical minerals sourced from the Democratic Republic of Congo (DRC).”

On solar, lawmakers continued to express interest in the Department of Commerce’s investigation into the “circumvention” of existing U.S. antidumping and countervailing duties (AD/CVD) on Chinese solar panels. H.J.Res.39 aims to nullify the Department of Commerce’s decision of September 22, 2022 to extend the waiver of certain AD/CVD duties of certain solar panels that are produced in Cambodia, Malaysia, Thailand and Vietnam but use parts and components that originate from China. The resolution was introduced on March 7, 2023, passed the House on April 28, 2023 and passed the Senate on May 3, 2023, but was vetoed by the President on May 16, 2023 and failed to be overridden by Congress. On August 18, 2023, the U.S. Department of Commerce determined that certain Chinese producers were shipping solar products through Cambodia, Malaysia, Thailand, and/or Vietnam for minor processing in an attempt to avoid paying antidumping and countervailing duties. Nevertheless, AD/CVD duties will not be collected on solar panels from the four countries at least until June 2024 pursuant to the earlier presidential order and department decision. Likely prompted by earlier discussions on China’s role in the solar supply chain, S.1643 Reclaiming the Solar Supply Chain Act of 2023 was introduced on May 17, 2023, to provide $3 billion in grants and loans over the next five years to strengthen U.S. manufacturing capabilities of solar panels and reduce reliance on China.

On pharmaceutical products and active pharmaceutical ingredients, as a continuation of past efforts to enhance U.S. supply chain resilience in their regard, three new bills were proposed to reduce reliance on China through various approaches. S.2454 Pharmaceutical Supply Chain Security Act would require a comprehensive strategy from the President to address the national security threats specifically related to China’s “control” of “the global supply of finished pharmaceutical products and active pharmaceutical ingredients” and reduce reliance on China by increasing investment for manufacturing and production through the U.S. International Development Finance Corporation (USIDC), among other means. H.R.4307/S.2115 Medical Supply Chain Resiliency Act would authorize the executive branch to negotiate trade agreements for medical goods and services between the United States and key allies and partners to reduce reliance on China. Finally, H.R.4449 Pharmaceutical Security Production Act would establish a “Commission on Strengthening the Domestic Pharmaceutical Supply Chain” to assess “the current security and vulnerabilities of the United States pharmaceutical supply chain” and make corresponding recommendations on legislative and regulatory actions.

Toolbox Against Unfair Trade

3. Congress is reshaping the policy toolbox to address “unfair trade practices.”

As the 118th Congress moves to examine more targeted issues and specific solutions to counter China in the area of trade and technology, lawmakers from both chambers expressed increasing concerns about the effectiveness and sufficiency of the existing U.S. policy toolbox. On the one hand, a significant focus was placed on the possible expansion of sanctions and export controls. On May 11, 2023, the House Foreign Affairs Committee held a hearing to review the Bureau of Industry and Security (BIS)’s practice of export controls on China, where former officials and outside experts criticized existing BIS export control practices for weak enforcement and for their inability to deny China access to critical technologies. On May 31, 2023, the Senate Banking Committee held a hearing entitled “Countering China: Advancing U.S. National Security, Economic Security, and Foreign Policy,” which summoned a number of U.S. officials including BIS top officials Matthew Axelrod and Thea Kendler. During the hearing, Republican lawmakers questioned the administration’s lack of initiative on export controls and sanctions, while, in a milder tone, Committee Chair Sherrod Brown consulted the officials’ opinion for legislative proposals to expand export and investment controls. This momentum continued on July 28, 2023, when leaders of the House China Committee wrote to U.S. Secretary of Commerce Gina Raimondo—while lauding the department’s “landmark rule” that restricts exports of advanced semiconductors and equipment to China—and urged further tightening of the rules and enforcement measures.

On the other hand, hearings and written exchanges occurred across a variety of committees to discuss a wide range of issues on (punitive) tariffs and related legal processes. On May 18, 2023, the House Foreign Affairs Committee’s Subcommittee on the Indo-Pacific held a hearing to “sound the alarm” on China’s “economic aggression and predatory practices” ahead of the G7 summit in Hiroshima, Japan. On May 25, 2023, the House Ways and Means Committee’s trade subcommittee held a hearing on “modernizing customs policies,” where the witnesses testified on the need to reform the de minimis rule of U.S. tariffs as well as the importance of ensuring compliance with U.S. sanctions related to forced labor concerns. On June 14, 2023, the House Foreign Affairs Committee held another hearing to summon U.S. officials to “assess U.S. efforts to counter China’s coercive Belt and Road Diplomacy.” In mid-July, 2023, the Senate Committee on Finance released U.S. Trade Representative (USTR) Katherine Tai’s response to the committee’s earlier inquiries. Among others, Tai was asked about the status of USTR’s statutory review of the Section 301 tariffs on Chinese goods. According to Tai, USTR continues to review “the overall structure of the tariffs, including which products should be subject to additional duties” and expects to finish the review “in the fall of this year.”

Congress’ vocal concerns on U.S. trade and tech control tools coincides with legislative proposals to reshape and expand the existing policy toolbox to address China’s “unfair trade practices.” Particularly worth noting is the reintroduction of both the Leveling the Playing Field 2.0 Act and the legislative proposal to reform the de minimis rule on import duties. On June 7, 2023, a bipartisan group of lawmakers reintroduced in both chambers of Congress the Leveling the Playing Field 2.0 Act, a revised and slightly more condensed version of the “Eliminating Global Market Distortions To Protect American Jobs Act of 2021” (also known as Leveling the Playing Field 2.0 Act then). The bill would “push back against China’s anti-free market practices by providing the Department of Commerce with more tools to stop circumvention tactics.” In particular, it would (a) create a new type of antidumping and countervailing duties (AD/CVD) investigation to address repeat offenders and those that aim to ‘circumvent’ AD/CVD by moving production to another country; (b) respond to China’s Belt and Road Initiative and allow the Department of Commerce to apply CVD law when a government provides subsidies to a company operating in a different country; and (c) further streamline processes of AD/CVD investigations and determinations. The bill was previously advocated by witnesses at the House China Committee’s May 17, 2023 hearing, “Leveling the Playing Field: How to Counter the Chinese Communist Party’s Economic Aggression.”

On the other hand, S.1969 De Minimis Reciprocity Act of 2023, the latest legislation proposed to reform the ‘de minimis rule,’ takes a different approach from previous legislation. Arguing that China is “tak[ing] advantage” of “outdated” U.S. customs laws and its ‘de minimis’ rule—the rule that goods with a claimed value of US$800 or less can enter U.S. markets without duties, U.S. Senators Bill Cassidy and Tammy Baldwin introduced the De Minimis Reciprocity Act of 2023. The bill would bar Chinese imports from using the ‘de minimis channel’; only allow express carriers to facilitate de minimis imports; and ask the Secretary of the Treasury to reset the de minimis threshold of each country, taking into account the country’s reciprocal threshold for imports from the U.S. The bill was introduced in the Senate on June 14, 2023, while witnesses called for de minimis reform at two earlier hearings in front of the House Ways and Means Committee and the House China Committee.

Relatedly, Congress has also sought to learn more about China’s practices in fields such as ocean shipping as well as means such as industrial subsidies. H.R.1836 Ocean Shipping Reform Implementation Act, which was reported by the committee to the House floor on May 23, 2023, would establish a “formal process” at the Federal Maritime Commission to receive complaints and investigate Chinese shipping companies and shipping exchanges. Introduced on May 17, 2023 and passed by the House on July 26, 2023, H.R.3395 U.S. Supply Chain Security Review Act of 2023 would require an assessment of “potential economic security risks of foreign ownership of marine terminals at the 15 largest U.S. container ports and recommending ways to address the risks.” On industrial subsidies, S.2545 Strengthening American Competitiveness Against Harmful Subsidies Act of 2023 would require the United States Trade Representative to regularly monitor China’s industrial subsidy practices, report on the corresponding risks to U.S. employment and manufacturing, and recommend legislative, administrative or other actions to mitigate the risks.

NDAA and Other National Security

4. Lawmakers balance national security across traditional and non-conventional areas of concern.

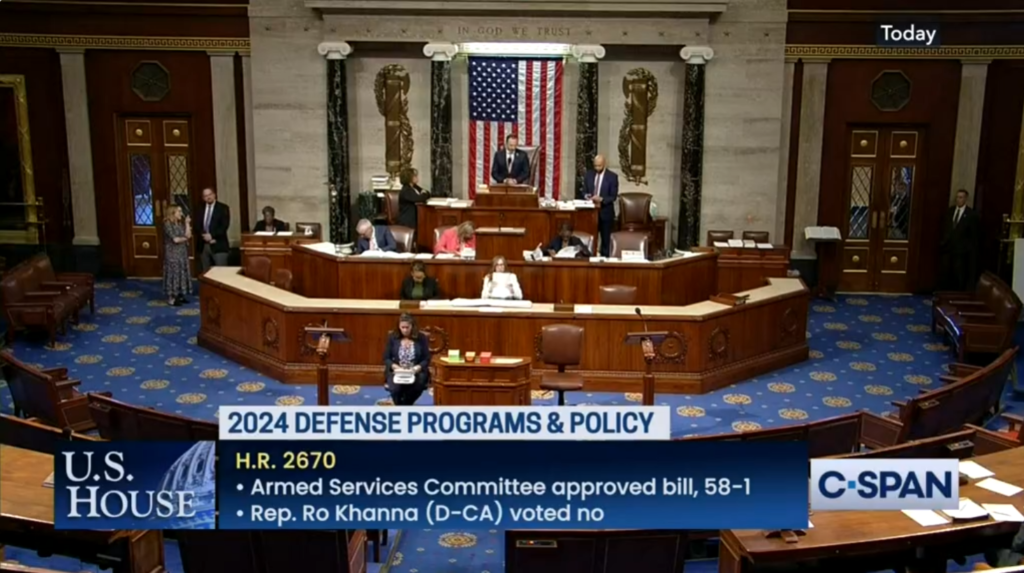

With legislative deliberations over the National Defense Authorization Act for Fiscal Year 2024 (FY24 NDAA) ongoing, Congress placed a heavier emphasis on traditional national security concerns related to China, but also continued to balance among traditional and non-conventional national security concerns. Although the Senate and the House have varying emphases and priorities with regard to the NDAA, both considered China a key issue of focus. The House Republicans’ statement on the NDAA, for example, explicitly listed provisions within the NDAA “to counter Communist China’s aggression.” These include “deterrence” efforts by extending the Pacific Deterrence Initiative, authorizing funding for the INDOPACOM Commander’s priorities, building more force projection capability, increasing funding for “essential military construction projects” and expanding “logistics capabilities in the Indo-Pacific,” increasing funding for relevant procurement authority and innovative new technologies and requiring efforts to “expand the deployable capacity of U.S. nuclear forces.” Additional emphasis was also placed on “strengthening homeland defense and preventing CCP espionage,” “support for Taiwan and Pacific allies,” and “countering China’s malign influence” such as “Chinese influence operations” among Indo-Pacific allies and “Chinese influence” in Africa and Latin America.

Meanwhile, the Senate Armed Service Committee’s June 2023 executive summary of NDAA 2024 states that the bill “supports the objectives of National Defense Strategy.” Released by the Department of Defense (DoD) on October 27, 2022, the unclassified version of the National Defense Strategy considers China as “the Department’s pacing challenge,” and lists “the PRC’s coercive and increasingly aggressive endeavor to refashion the Indo-Pacific region and the international system” as “the most comprehensive and serious challenge to U.S. national security.” Relevant provisions in the Senate’s version of the FY24 NDAA include budget authorization for the Pacific Deterrence Initiative (PDI), the establishment of the Indo-Pacific Campaigning Initiative to “facilitate INDOPACOM’s campaigning activities in the region,” supports for DoD activities related to AUKUS, and the establishment of “a comprehensive training, advising, and institutional capacity-building program for the military forces of Taiwan.” The NDAA also provides resources to the military to “carry out the National Defense Strategy and out-compete, deter, and, if necessary, prevail against near-peer adversaries.” Related efforts and provisions have focused on issues such as the procurement of naval vessels, combat aircraft, armored vehicles, weapon systems, and munitions; multiyear procurement of the next block of Virginia-class submarines; maintenance of Navy carrier air wings; increased funding for cutting-edge technologies; and the establishment of a joint DoD-NNSA program to “address China’s nuclear breakout.” The Senate’s version also highlighted intelligence-related issues, including efforts to establish coordinated efforts “to hold China accountable for its egregious human rights abuses,” and to enhance general capacities in security classification and congressional oversight.

Additionally, some lawmakers also increased efforts to “prevent Chinese, Russian influence in national security contracting.” Cautioning against depending on consulting firm McKinsey & Company, whose past clients include the Chinese and Russian governments, Senator Joni Ernst introduced S.2034 CONSULT Act of 2023 to prohibit the DoD from contracting with consulting firms that have such “conflicts of interest.” Specifically, the bill would prohibit DoD from awarding contracts related to national security industries to consulting firms which work with sanctioned and adversarial entities, streamline federal policies to identify potential conflicts of interest within consulting firms or government contractors, and provide a mechanism for DoD to terminate applicable contracts.

As for non-conventional national security concerns, legislative actions covered a wide range of issue areas, such as the controls of critical technology outflows, critical minerals supply chain resilience, public health and foreign investment in American farmlands. With regard to technology control, lawmakers tended to focus on disparate “loopholes” that are relatively narrow in scope. For example, S.2170 DENIAL Act of 2023 would require the Bureau of Industry and Security (BIS) to adopt a presumption of denial before approving export controls licenses for end users in China or Russia. S.2114/H.R.820 Foreign Adversary Communications Transparency Act would direct the Federal Communications Commission to publish Chinese entities that hold authorizations and licenses issued by the Commission. H.R.5209 Stopping Genetic Monitoring by China Act would impose export controls and sanctions to address the “security threat posed by” China’s “genetic mapping efforts.” H.R.4683 would prohibit support for the remote use or cloud use of certain “integrated circuits” by Chinese entities to “close loopholes for the overseas use and development of artificial intelligence.”

Meanwhile, efforts to enhance the supply chain resilience of critical minerals have overlapped with these national security concerns. National security concerns were cited, for example, when bills proposed to reduce reliance on China by developing a national strategy to enhance critical minerals supply chain reliance, or establish a task force to “address national security risks associated with America’s critical mineral supply chains.” An increasing number of bills have additionally addressed the fentanyl crisis as a national security concern, and the focus on protecting U.S. farmlands and agriculture from foreign investment and ownership also continued through the summer of 2023.

Continued Focus on Taiwan

5. Taiwan continues to be a hot topic.

Taiwan continues to be a hot topic on the hill, and legislative actions on Taiwan had three general areas of focus: trade and investment; security; and international recognition and global coalition-building efforts. On June 1, 2023, representatives of the American Institute in Taiwan (AIT) and the Taipei Economic and Cultural Representative Office (TECRO) in the United States signed the first agreement under the U.S.-Taiwan Initiative on 21st Century Trade. The signing of the agreement soon sparked discussions in Congress with regard to both U.S.-Taiwan trade and congressional authority over international trade agreements. On June 12, 2023, Rep. Jason Smith introduced H.R.4004 United States-Taiwan Initiative on 21st-Century Trade First Agreement Implementation Act in the House. On June 21, 2023, the House approved the bill “to reassert Congress’ sole authority over international trade while showcasing significant support for the U.S.-Taiwan relationship.” The bill confirms Congress’ support for the “Initial Agreement” that was negotiated by the Biden Administration and Taiwan and requires the administration to report and consult with Congress on any successor agreements with Taiwan, going forward. It passed the Senate on July 18, 2023 and was signed into law on August 7, 2023. However, the signing statement of President Biden stated that the administration will treat the requirements to provide negotiation texts as non-binding if they “impermissibly infringe upon [the President’s] constitutional authority to negotiate with a foreign partner.”

In addition to the trade agreement, legislative actions also proceeded in two other areas in the field of trade and investment: taxation arrangements and potential investor risks. On the former, S.1457/H.R.4729 Taiwan Tax Agreement Act of 2023 would authorize the Biden administration to negotiate and conclude a tax agreement between the United States and Taiwan to “facilitate investment between the United States and Taiwan in key strategic industries such as semiconductors,” among other objectives. The bill specifies that such a “tax agreement” does not constitute a tax “treaty.” Echoing the bill, H.Res.449 expresses the sense of the House that the President and the Senate should work with the House to “to avoid or mitigate double taxation between the United States and Taiwan” and that the President should “proactively seek other ways to increase trade, technology, and investment ties between the United States and Taiwan.” On the latter, H.R.4450 Mitigating Investor Risk Act of 2023 asks the Secretary of the Treasury to “assess the risk posed by the exposure of United States investors to investments in People’s Republic of China companies in the event of hostilities in Taiwan or the Taiwan Strait.”

On the security front, legislative proposals can be roughly grouped into three categories. First are strategy and contingency plan. For example, S.1074/H.R.2449 Taiwan Protection and National Resilience Act of 2023 would “require the U.S. Department of Defense (DoD), the Department of Commerce, the Department of State, and other federal agencies to report to Congress on the United States’ non-kinetic options to both prepare for and respond to a CCP attack on Taiwan, including opportunities to sanction the CCP and preempt Beijing’s retaliatory measures.”

Second, plans to increase U.S. military capabilities in the region. These include relevant provisions in NDAA 2024 such as budget increase in accordance with the National Defense Strategy and specifically with regard to the Pacific Deterrence Initiative, INDOPACOM campaigning, and AUKUS. Separately, Senator Marco Rubio proposed S.1566 Deterring Chinese Preemptive Strikes Act of 2023 on May 11, 2023, which would direct the Department of Defense to “harden U.S. facilities in the Indo-Pacific to deter a preemptive strike against U.S. forces and assets in the region by China ahead of an invasion of Taiwan.”

Third, proposals to increase Taiwan’s security capabilities. Now included in FY24 NDAA, S.1997/H.R.5072 Taiwan Peace through Strength Act of 2023 would “strengthen U.S.-Taiwan defense ties” by “expediting and prioritizing U.S. military sales to Taiwan,” “clarifi[ng] U.S. authorities to arm Taiwan in the Taiwan Relations Act,” “establishing regular combined U.S.-Taiwan exercises, training, and professional exchanges” and “applying Ukraine munitions production capacity authorities to Taiwan.” Also now included in the Senate version of NDAA 2024, S.2226 STEADFAST Act would streamline and expedite the foreign military sales process of “major non-NATO allies,” which specifically include Taiwan. On June 30, 2023, Senator Dan Sullivan additionally introduced S.2057, a bill to “require the Secretary of Defense to deliver on foreign military sales to Taiwan.”

Beyond trade and security matters, a number of other bills focused on preserving Taiwan’s status and advancing its international recognition. Introduced by Rep. John Curtis on May 10, 2023, H.R.3171 Taiwan Representative Office Act would rename the Taipei Economic and Cultural Representative Office to the Taiwan Representative Office. Bringing international organizations into the frame, H.R.1176/S.1513 Taiwan International Solidarity Act would require that the United States should “as a member of any international organizations, should oppose any attempts by the People’s Republic of China to resolve Taiwan’s status by distorting the decisions, language, policies, or procedures of the organization.” Finally, H.Res.352 expresses “the sense of the House of Representatives on the importance of a unified transatlantic role in deterring the Chinese Communist Party from disrupting the peace and stability in the Taiwan Strait,” while S.Res.273 expresses concerns that “Latin American and Caribbean countries that recognize Taiwan will receive economic coercive pressure from PRC.”

What global firms should take note of after U.S. Supreme Court’s ruling on Trump’s tariffs