U.S. Rep. Tim Walberg (R-MI) discusses H.R. 4468 – Choice in Automobile Retail Sales (CARS) Act of 2023 at House floor debate on December 6, 2023. Source: C-SPAN (Video Screenshot).

Research Associate

Part-Time Research Assistant

In May 2023, the team at the Institute for China-America Studies (ICAS) launched the U.S.-China Legislative and Executive Actions Directory (L.E.A.D.) Project to track and summarize trending critical issues and developments on China, emanating from both the White House and Capitol Hill.

This is the fourth release of the Legislative Actions Directory and the first legislative release in 2024, covering U.S. legislative moves on China from January to April, 2024.

The 118th Congress embraced its one-year countdown by continuing to push for laws that restructure policies in key areas of concerns. From January to April 2024, lawmakers introduced 63 bills and made significant advances on 25 bills on China and China-related issues. Among all, the bills’ primary focuses include addressing green products overcapacity and green energy self-reliance, continued tech and economic decoupling with China, shipping and port security, the competition on frontier technologies, and Taiwan.

Buzzword of the first quarter of 2024 will undoubtedly be “overcapacity.” Echoing the Biden administration’s call to address China’s alleged overcapacity in green product manufacturing, Congress introduced a significant number of bills that carried strong protectionist elements. Citing concerns on China’s dominance in green energy supply, lawmakers also advocated for strengthening U.S. green energy self-reliance. The efforts to strengthen self-reliance also coincided with the continuous push for tech and economic decoupling this quarter. An epitome of that combination is the Congress-led investigation on China-made cranes and the subsequent push for reforming and securing U.S. shipping industries and ports. Meanwhile, Congress aimed at further blocking Chinese access to sensitive U.S. data, emerging technologies, and capital, while channeling more funding to frontier technology research to better compete with Beijing in emerging industries and standard setting. On the foreign policy front, Taiwan continued to be the most frequently discussed geopolitical issue on the Capitol Hill. Congress pushed for more legislation during this quarter to demonstrate and strengthen U.S. commitment to Taiwan as the two sides of the Pacific brace for a new Taiwan administration this May.

As the White House becomes increasingly concerned about highly competitive China-made electric vehicle (EV) imports, lawmakers from both parties and both chambers have also made several moves to address this issue. Calls for proactive actions related to EV emerged even before the Biden administration announced its official responses to China-made EVs. On April 11, 2024, Senator Sherrod Brown (D-OH) sent a letter to President Biden, calling for executive actions to “ban Chinese-made electric vehicles to protect Ohio autoworkers, and to combat the economic and national security threats posed by Chinese automakers.” On February 28, 2024, one day before President Biden announced “unprecedented actions” to investigate automobiles that use technology from China, Senator Josh Hawley (R-MO) introduced S.3831 – Protecting American Autoworkers from China Act of 2024 to protect the U.S. automobile industry from Chinese EVs by raising the tariffs on Chinese automobiles. The bill would apply a total tariff of 125% on all automobiles produced in China as well as all automobiles produced by Chinese companies or subsidiaries thereof regardless of where they are actually manufactured.

After the Biden administration announced a series of actions to address the ‘inflood’ of Chinese EVs into the U.S. market on February 29, 2024, more congressional moves followed. On the same day, Rep. Elissa Slotkin (D-MI), who previously called for the administration to brief Congress about national security threats associated with Chinese autonomous vehicles operating in the U.S., immediately applauded the White House’s decision to investigate Chinese electric vehicles and autonomous vehicles. On March 5, 2024, Senator Marco Rubio (R-FL) introduced three bills to protect the U.S. automobile industry. Similar to Senator Hawley’s S.3831, S. 3868 – Strengthening Tariffs on Chinese Autos Act would impose a flat tariff of $20,000 on all Chinese automobiles that enter the U.S. market, while S.3863 – Closing Auto Tariffs Loopholes Act would treat automobiles produced by Chinese companies the same as automobiles produced in China. Additionally, S.3869 – American Subsidies for American Autos Act of 2024 requires all electric vehicles that receive federal subsidies to comply with the United States-Mexico-Canada Agreement’s (USMCA) rules-of-origin and labor value content criteria. Senator Rubio considers the USMCA rules to be “far more protective of American jobs” than those under the Inflation Reduction Act.

The aforementioned moves to investigate and restrict Chinese EV imports echoed a larger trend in Congress. U.S. lawmakers—mostly but not all Republicans—have long expressed concerns about increasing U.S. reliance on China for its green energy supplies, especially given the Biden administration’s decision to accelerate the U.S. green transition. Most recently, on January 31, 2024, Rep. Dan Newhouse (R-WA) introduced H.Res.987. In “denounc[ing] the harmful, anti-American energy policies of the Biden administration,” the resolution highlighted U.S. reliance on China for “minerals necessary for renewable energy development.” The resolution was agreed to in the House on March 21, 2024, receiving 213 votes from House Republicans and 4 from House Democrats. On April 4, 2024, House Energy and Commerce Committee Chairwoman Cathy McMorris Rodgers (R-WA) issued a statement which blamed the Biden administration’s “rush-to-green agenda” and its failure to prevent U.S. funds from “enriching China, which dominates the supply chains for renewable and electric vehicles.”

Accordingly, the U.S. Congress launched a number of moves to address and reduce U.S. reliance on China in the green energy sector. In addition to the topic of electric vehicles, legislative efforts have focused on three aspects: (1) supporting the U.S. green industry and the U.S. market against Chinese imports; (2) securing and incentivizing alternative critical minerals supplies; and (3) developing green energy that currently does not rely on Chinese supplies.

(1) As concerns about U.S. competitiveness in electric vehicles intensify, legislative efforts have continued to protect the U.S. green energy industry and reduce reliance on China. On March 5, 2024, Senator Josh Hawley (R-MO) introduced S.3866 – Declaring Our Energy Independence from China Act of 2024 to “counter the Biden Administration’s energy surrender” to America’s greatest adversary” by imposing additional tariffs on a number of green energy products from China, including battery components, solar panels and wind energy components. Similarly, during the House Finance Services Committee hearing on March 12, 2024, witnesses argued for increase in federal and defense spending support on U.S. solar, electric vehicle and critical minerals industry, citing the risks of U.S. reliance on China.

(2) Endeavors to secure critical mineral supplies and reduce reliance on China have focused on two fronts. First, lawmakers have continued to place attention to cobalt, other critical minerals and rare earth, echoing an array of bipartisan and bicameral actions last year. On December 29, 2024, Rep. Christopher Smith (R-NJ) introduced H.R. 6909 – COBALT Supply Chain Act to prohibit the import of cobalt refined in China, expressing concerns about labor practices in cobalt mining in the Democratic Republic of Congo (DRC) and China’s “near monopoly” in DRC’s cobalt sector. On March 22, 2024, Rep. Jay Obernolte (R-CA) introduced H.R.7807 – Intergovernmental Critical Minerals Task Force Act to create an intergovernmental task force to combat U.S. reliance on China for critical minerals and rare earth. The bill is a companion of S.1871 – Intergovernmental Critical Minerals Task Force Act, which was introduced by Senator Gary Peters (D-MI) on June 8, 2023 and received support from Senators Mitt Romney (R-UT) and James Lankford (R-OK). One day earlier, on March 21, 2023, the House Foreign Affairs Committee held a hearing that featured, among others, Department of State’s Undersecretary for Economic Growth, Energy, and the Environment Jose W. Fernandez. Highlighting the need to promote U.S. businesses abroad and confront China’s “predatory economic practices,” Mr. Fernandez argued for the importance of strengthening critical minerals supply chains and specifically, the Minerals Security Partnership.

Second, new interests are emerging on the hill to support deep-sea mining as a way to secure critical minerals essential to the green transition. On March 15, 2024, Rep. Wesley Hunt (R-TX) introduced H.Res.1082 to call upon the International Seabed Authority—the international organization that governs deep seabed beyond national jurisdiction—to adopt regulations and allow for the mining of critical minerals from the deep seabed. The resolution argues that such a move would enable the U.S. to “regain” reliable and responsible supplies of critical minerals, secure supply chains away from China and create high-wage jobs for U.S. citizens. Meanwhile, Rep. Carol Miller (R-WV) introduced H.R.7636 – Responsible Use of Seafloor Resources Act of 2024 on March 12, 2024. The bill would provide financial and diplomatic support to the collection, processing and refinery of deep-sea critical minerals and demand further reports and analyses into the field. The emergence of these congressional moves could have been influenced in part by the Biden administration’s earlier decision to announce the outer limits of the U.S. continental shelf on December 19, 2023, as deep-sea minerals are an important resource on the continental shelf.

(3) Washington’s undertaking to strengthen the U.S. green energy sector has also led to new legislative advances in the field of nuclear energy. On February 28, 2024, H.R.6544 – Atomic Energy Advancement Act passed House on a vote of 365 to 36. The bill aims to deliver affordable, reliable and clean energy to the United States by optimizing the licensing, regulation and deployment of nuclear energy technologies. Introduced on December 1, 2023, the bill combines 11 pieces of legislation proposed by members of the House Energy and Commerce Committee. The Atomic Energy Advancement Act echoes earlier bipartisan efforts in the Senate to strengthen U.S. global leadership in nuclear energy, enhance U.S. competitiveness in the global nuclear markets and offset China and Russia’s growing influence. Other House lawmakers have also introduced bills to support critical nuclear energy infrastructure projects in the United States or address China’s “dominance” in international nuclear energy financing.

As the 118th Congress began its second year, U.S. lawmakers launched several waves of actions to intensify U.S.-China decoupling. On digital platforms and the digital economy, the much reported and publicized TikTok bill—H.R.7521 – Protecting Americans from Foreign Adversary Controlled Applications Act—would require ByteDance to divest its interests in TikTok by banning “a foreign adversary controlled application” from “distributing, maintaining or providing internet hosting services” in the U.S. The bill was introduced in the House on March 5, 2024 and swiftly passed the House on March 20, 2024. It passed both chambers as part of the emergency supplemental appropriations bill on April 23, 2024 and became law on April 24, 2024. Meanwhile, likely echoing long-lasting and ongoing efforts to enact a nationwide data privacy law, the U.S. Congress has successfully advanced legislation to tighten federal control over the flow of sensitive data—by banning all cross-border data transactions to China and other “foreign adversaries.” On March 5, 2024, the same day the TikTok bill was introduced, Rep. Frank Pallone (D-NJ) introduced H.R.7520 – Protecting Americans’ Data from Foreign Adversaries Act of 2024. The bill prohibits any “data broker” from selling, trading, transferring or releasing “personally identifiable sensitive data” of U.S. residents to China, Chinese companies and any entity that is based in, headquartered in, or primarily operates in China, among others. Similar to the TikTok bill, H.R.7520 passed the House on March 20, 2024 and became law as part of the emergency appropriations bill on April 24, 2024.

Meanwhile, in an effort to reform and expand U.S. policy toolbox to prevent both technology and capital flows to China, U.S. lawmakers have begun exploring a new concept for techno-economic statecraft. On January 18, 2024, the Senate Banking Committee held a hearing titled “National Security Challenges: Outpacing China in Emerging Technology.” During the hearing, Ms. Lindsay Gorman, Senior Fellow For Emerging Technologies from The Alliance for Securing Democracy at the German Marshall Fund of the United States, advocated for a “new mode of techno-economic statecraft” to best address U.S. competition with China. According to Ms. Gorman, the U.S. competition with China “is playing out chiefly in non-traditional spheres of battle: technology, economy, and society, in addition to military capability build-ups.” Accordingly, “outpacing China” also means “impeding [China’s] capabilities in select game-changer and ‘force-multiplier’ technologies,” and Washington and its allies should change its approach and build up policy tools and capacities to “control capabilities, not only technologies” when it relates to China. Echoing Ms. Gorman’s argument for a conceptual shift in U.S. techno-economic statecraft, the House Foreign Affairs Committee expressed similar thinking to reform the existing export controls regime when developing mechanisms for capital controls. On March 21, 2024, the House Foreign Affairs Committee held the hearing “Countering China on the World Stage: Empowering American Businesses and Denying Chinese Military Our Technology.” During the hearing, committee chair Michael McCaul (R-TX) expressed concerns that an entity-based approach to screen technology or financial outflows could be a game of Whac-A-Mole—losing effectiveness as soon as the target company “changes its name overnight.” Accordingly, Rep. McCaul asked BIS head Alan Estevez whether it is possible to both expand the existing sanctions regime and combine it with a “sector-based approach”—where the U.S. government actively prohibits or significantly limits all concerning transactions in sensitive industries.

Concurrent with the congressional deliberations on the shift of methods and concepts, U.S. lawmakers have continued to introduce a wide range of specific proposals to control or limit capital flows to China. On March 14, 2024, Senator J.D. Vance (R-OH) introduced S.3945, a bill to prohibit the Chinese governments or any state-controlled entities from accessing the U.S. capital market until China changes its position on “the public international doctrine of state succession,” “the successor government doctrine with respect to sovereign debt” and all “United States and foreign laws and regulations governing transparency and disclosures” in capital markets. On March 20, 2024, Reps. Brad Sherman (D-CA) and Victoria Spartz (R-IN) introduced four bills to increase U.S. taxes on investment in China, require publicly traded companies to disclose their “dependency” on China, prohibit Americans from purchasing stocks of Chinese companies currently on U.S. sanctions lists, and prohibit index funds from investing in Chinese stocks. Meanwhile, U.S. lawmakers continued to propose varied bills that would prohibit Chinese persons and entities from purchasing (certain) U.S. land and real estate.

On March 7, 2024, The Wall Street Journal reported that a Congress-led investigation found that China-made cargo cranes “throughout” U.S. ports could pose serious national security risk. In a later press release on March 12, 2024, House Homeland Security Chair Mark Green (R-TN), Subcommittee on Transportation and Maritime Security Chairman Carlos Gimenez (R-FL), and House China Committee Chair Mike Gallagher (R-WI)—the three lawmakers who initiated the investigation—detailed their “shocking findings” that Shanghai Zhenhua Heavy Industries (ZPMC), “a company with close ties to the Chinese Communist Party (CCP),” had installed within their ship-to-shore crane components “communication devices” that are not part of the equipment contracts and that port officials could not determine the reasons why the components have been installed. ZPMC denied the findings and argued that the media reports of the investigation can be “misleading without sufficient factual review.”

Although reports on the Chinese spy cranes only received wide coverage in recent months, U.S. lawmakers have long spent efforts to address China’s presence across various aspects of the global maritime shipping industry. Following the enactment of the Ocean Shipping Reform Act (Public Law 117-146) on June 16, 2022, the bill’s two original sponsors, Reps. Dusty Johnson (R-SD) and John Garamendi (D-CA) introduced “Ocean Shipping Reform 2.0,” H.R.1836 – Ocean Shipping Reform Implementation Act of 2023 on March 28, 2023. The new bill would further “protect U.S. ports and shippers from the Chinese Communist Party’s influence” by increasing the Federal Maritime Commission’s capability to regulate cross-border ocean shipping, prohibit usage of China’s LOGINK logistics information platform, and increase U.S. visibility into shipping exchanges and maritime freight logistics. The Ocean Shipping Reform Implementation Act passed the House on March 21, 2024. The two sponsors argued that the passage of the bill “gets us one step closer to further securing our ocean shipping supply chains” and to “crack down on China’s unfair shipping practices.”

Meanwhile, several other lawmakers also joined the congressional and executive’s momentum to scrutinize China’s presence in global shipping. On April 10, 2024, a group of 38 House lawmakers, led by Rep. Joe Courtney (D-CT), ranking member of the House Seapower subcommittee, sent a letter to U.S. Trade Representative Katherine Tai, calling on the agency to investigate China’s “unfair trade practices in the maritime, logistics, and shipbuilding sector.” The White House quickly announced the initiation of an investigation accordingly on April 17, 2024, which Rep. Courtney applauded. On April 5, the House Homeland Security Committee held a field hearing in Miami, Florida, where lawmakers, federal and local officials, industrial representatives and experts shared their view on the “emerging challenges to safety and security at United States ports as well as the state of port infrastructure and future investment needs,”

Echoing earlier actions by the Biden administration to increase U.S. participation in the development of international standards for critical and emerging technologies, Senators Mark Warner (D-VA) and Marsha Blackburn (R-TN) introduced the S. 3849 – Promoting United States Leadership in Standards Act of 2024 on February 29, 2024. The bill aims to “reestablish U.S. leadership in international standards-setting for emerging tech” by incentivizing private stakeholders to engage in international standardization efforts and by offering grants to support the hosting of standards meetings for AI and other critical and emerging technologies in the United States. It also adds several requirements for the National Institute of Standards and Technology (NIST) to report relevant government work and progress to Congress.

As legislative endeavors to reshape trade relations with China have gradually turned to specific sectors of concern that could generate sufficient political momentum—e.g.,the aforementioned electric vehicle and green energy sector, Congress has placed increasing attention to the technology competition with China. Following earlier attempts in 2023 to explore and understand emerging technologies such as artificial intelligence (AI), the 118th Congress has widened its scope of inquiry in 2024 in two ways. First, Congress has sought to understand more about emerging technologies, their applications in China and the relevant policy impacts. On February 1, 2024, the U.S.-China Economic and Security Review Commission (USCC) held an all-day hearing, where 10 experts presented on topics such as the national security risks behind Chinese information technology products, China’s commercial and military application of AI and quantum technology, and China’s latest development and progress in biotechnology.

Second, Congress is also actively exploring and evaluating new strategy and new thinking regarding its technology policy, especially in the area of technology controls. On January 18, 2024, the Senate Banking Committee hosted a hearing entitled “National Security Challenges: Outpacing China in Emerging Technology,” where three experts were invited to share their opinion about possible policy tools to outcompete China in emerging technologies. Among them, Ms. Lindsay Gorman of the German Marshall Fund advocated for a “new mode of techno-economic statecraft”—namely, that the United States should focus on controlling the technology capabilities of its opponent(s) instead of the end use or impact of the technology. Mr. Jamil Jaffer of the George Mason University recommended coordinated actions within the government and between the public and the private sector to address emerging technology threats from China. Ms. Emily Kilcrease of Center for a New American Security called for a number of specific actions, including better administration of export controls under the Department of Commerce, expansion of the authority under the Committee on Foreign Investment in the United States (CFIUS), and the codification of outbound investment controls.

Onto specific policy concerns, U.S. lawmakers focused on four issues in the first four months of 2024: (1) biotechnology, (2) U.S.-China research ties, (3) intellectual property and (4) reform of export controls.

First, building on prior legislative moves in 2023 and beyond, congressional momentum made several advances to support and shield U.S. biotechnology companies from certain data and business exchanges with China. On January 25, 2024, Rep. Mike Gallagher (R-WI) introduced H.R.7085 – BIOSECURE Act, which would prohibit the U.S. government from procuring or obtaining any biotechnology from Chinese companies, or contracting with entities that use biotechnology equipment or services from China. H.R.7085 echoes a similar bill in the Senate, S.3558, which also aims to prohibit the U.S. government from contracting with Chinese companies to secure biotechnology or contracting with entities that use Chinese biotechnology. S.3558 was introduced by Senator Gary Peters (D-MI) on December 20, 2023. The Senate Committee on Homeland Security and Governmental Affairs reviewed and marked up the bill on March 6, 2024.

Meanwhile, a bipartisan, bicameral group of lawmakers have advanced a bill to prohibit companies owned or controlled by the Chinese government from receiving federal contracts, grants and loans. Under the Prohibiting Foreign Access to American Genetic Information Act of 2024, a fast-track “ban” would apply to the BGI Group (BGI), MGI, Complete Genomics, WuXi AppTec to prohibit them from receiving federal support. According to the sponsors of the bill, the prohibition of federal funds would “help prevent foreign adversaries from stealing sensitive American genetic data and personal health information.” The argument likely echoes some earlier legislations introduced in late 2023, which propose to directly prohibit certain Chinese biotechnology companies from accessing American genetic data and personal health information. House China Committee’s Chair and ranking member, Reps. Mike Gallagher (R-WI) and Raja Krishnamoorthi (D-IL) jointly introduced the Prohibiting Foreign Access to American Genetic Information Act on January 25, 2024. Senate Homeland Security Committee Chair Gary Peters (D-MI) and Senator Bill Hagerty (R-TN) advanced the bill in the Senate on March 6, 2024. One day after the Senate advancement, on March 7, 2024, the House China Committee held a hearing on the bioeconomy and national security, in which experts and industrial representatives cautioned U.S. policymakers about the significance of cutting-edge biotechnologies and China’s attempt to “dominate the biorevolution.”

Second, building on a wealth of legislative moves in 2023 to sever research and educational ties between the U.S. and China, the U.S. Congress pressed on with controlling and restricting U.S.-China science and technology engagements. On February 15, 2024, the House Science Committee held a hearing that featured a wide range of U.S. officials to examine federal science agency actions to secure the U.S. science and technology enterprise. Viewing U.S. technology advancement and research and development from the lens of U.S.-China strategic competition, the officials highlighted the need to enhance “research security,” “inform” researchers about the need to caution or cut ties with certain Chinese counterparts as well as the development of measures to counter “undue foreign influence” in research. On March 21, 2024, the House Committee on Foreign Affairs voted 50-0 to advance H.R.5245 – Science and Technology Agreement Enhanced Congressional Notification Act of 2023, a bill that requires the U.S. government to notify Congress before entering into, renewing, or extending a science and technology agreement with China.

Third, echoing earlier efforts in 2023 to protect intellectual property (IP) for “U.S. national security, economic interests and technological competitiveness,” lawmakers continued to strengthen policy tools to safeguard sensitive IP. On March 11, 2024, Rep. John Curtis (R-UT) introduced H.R.7608 – CCP IP Act, which would authorize the U.S. government to sanction persons and companies that “operate in a sector of the People’s Republic of China’s economy” and engage in “a pattern of significant theft of the intellectual property of a United States person.” On February 2, 2024 and April 10, 2024, the Senate Judiciary Committee hosted Part 2 and Part 3 of its “Artificial Intelligence and Intellectual Property” hearings to discuss the possibility of expanding IP protection in certain fields of the artificial intelligence sector. The issue of IP was also mentioned by Rep. Kevin Hern (R-OK) as he introduced H.R.7476 – Counter Communist China Act, which the Republican Study Committee proposed as the largest and most comprehensive legislation addressing the Chinese Communist Party.

Fourth, U.S. lawmakers have continued to examine the U.S. export controls system. On March 21, 2024, the House Foreign Affairs Committee held a hearing on “Countering China on the World Stage: Empowering American Businesses and Denying Chinese Military Our Technology,” joining several other congressional committees which previously used hearings as a means to look into the effectiveness of U.S. export controls and related measures in controlling sensitive technologies. During the hearing, the Commerce Department’s Bureau of Industrial Security (BIS) head Alan Estevez argued for the importance of multilateral coordination in controlling technologies from China, defended BIS’s licensing practices and highlighted progress made by the Disruptive Technology Strike Force. The statements echoed an earlier hearing at the same committee on January 17, 2024, where both Commerce and State officials underscored their concerns about China’s military-civil fusion strategy and the need to tighten the U.S. export control system accordingly while ensuring that export controls are conducted on a multilateral basis.

Taiwan continued to be a focal point for congressional discussions related to China in the first 4 months of 2024 as lawmakers continued to explore various ways to reaffirm U.S. commitment to Taiwan and deter or prepare for a possible Taiwan contingency. On January 11, 2024, two days before the election in Taiwan on January 13, 2024, Senator Dan Sullivan (R-AK) introduced S.Res.521 “commending Taiwan for its history of democratic elections, and expressing support of Taiwan’s democratic institutions.” The resolution was agreed upon in the Senate on the same day it was introduced. Meanwhile, Rep. Gerald Connolly introduced a similar resolution, H.Res. 955, on January 9, 2024, but the bill was stuck at committee review since then.

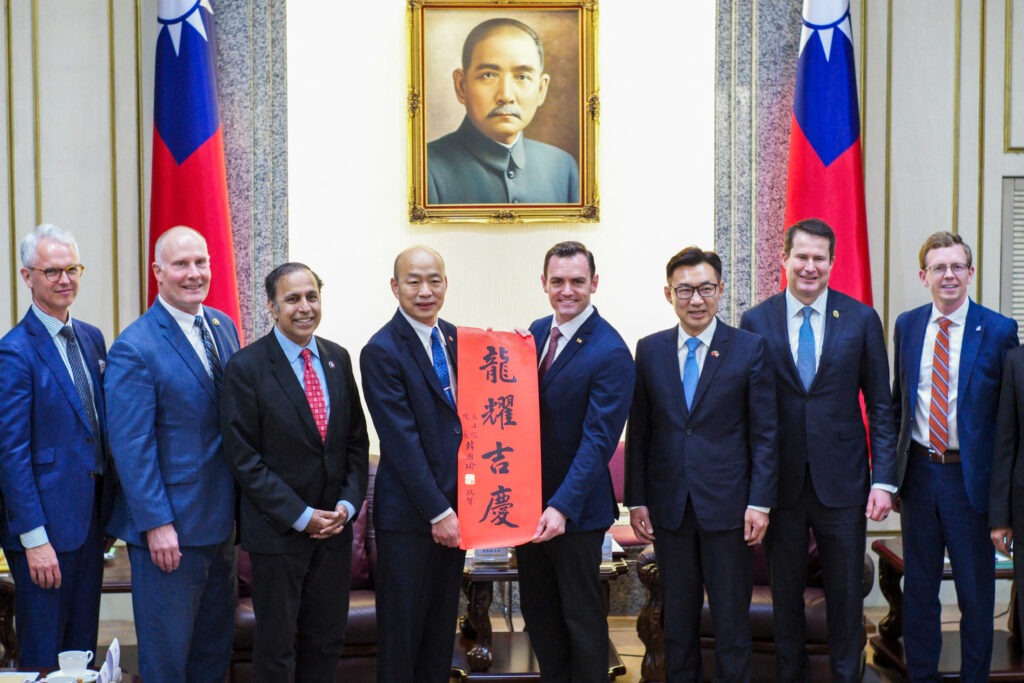

On the committee and caucus level, two trips were also made to Taiwan to “reaffirm U.S. support.” On January 24, 2024, Reps. Ami Bera (D-CA) and Mario Díaz Balart (R-FL), co-chairs of the Congressional Taiwan Caucus, arrived in Taipei. From February 22-24, 2024, House China Committee Chair Mike Gallagher (R-WI) led a delegation of China committee members to visit Taiwan.

Meanwhile, proposed legislations on Taiwan have primarily focused on measures—especially economic and diplomatic ones—to deter or prepare for a possible Taiwan contingency. On the economic side, recent congressional efforts have focused on targeted, supplementary countermeasures as well as preparatory work such as info-gathering. On March 5, 2024 Senator John Cornyn (R-TX) introduced S.3861, a bill to terminate the U.S.-China income tax convention if the People’s Liberation Army “initiates an armed attack against Taiwan.” Rep. Tony Gonzales (R-TX) introduced S.3861’s companion bill in the House, H.R.7874, on April 5, 2024. On March 20, Rep. Brad Sherman (D-CA) introduced H.R. 7757 – China Risk Reporting Act to require publicly traded companies to file reports with the SEC about their dependency on China and the steps they have taken to reduce its “China risk.” According to Rep. Sherman, the bill seeks to “force companies competing for capital to reduce their exposure to China” and accordingly, enable Congress to impose sanctions in case China uses force against Taiwan, “knowing American companies have insulated themselves from the rupture.” “Hopefully, this will deter such an invasion.” In a similar vein, Reps. Blaine Luetkemeyer (R-MO) and Ritchie Torres (D-NY) introduced the H.R.7954 – Fortifying U.S. Markets from Chinese Military Aggression Act on April 11, 2024, which seeks to “develop an economic plan to mitigate the catastrophic economic fallout from potential Chinese military aggression towards Taiwan.”

On the diplomatic side, lawmakers turned to Taiwan’s presence and representation in international institutions, with a targeted focus on international financial institutions. On January 12, 2024, the House passed H.R. 803 – PROTECT Taiwan Act. Under the bill, if the President informs Congress of any threat from China to Taiwan’s security or social or economic system and associated U.S. interests, the U.S. government is required to “take all necessary steps” and exclude China’s representatives from international financial institutions such as G20, the Financial Stability Board, and the Basel Committee on Banking Supervision. Reps. Frank Lucas (R-OK) and Vicente Gonzalez (D-TX) originally introduced the bill on February 2, 2023, but the bill only passed committee review on December 1, 2023. The House passage of the PROTECT Taiwan Act likely corresponds to concurrent efforts to ensure Taipei’s treatment at international financial institutions. On January 12, 2024, the same day the House passed the PROTECT Taiwan Act, the House also passed H.R.540 – Taiwan Non-Discrimination Act to require the Secretary of the Treasury to “pursue more equitable treatment of Taiwan at the international financial institutions.” Rep. Young Kim (R-CA) introduced the bill on January 26, 2023 and the bill also passed committee review on December 1, 2023.

On the military side, lawmakers continued to voice concerns about U.S. support for Taiwan through moves such as arms sale. On February 14, 2024, the House Foreign Affairs committee held a full committee hearing on AUKUS Implementation and Challenges to International Security and Arms Control in the 21st Century. During the hearing, Chairman Michael McCaul (R-TX) voiced concerns about “incomplete” arms sale to Taiwan, while Rep. Andy Barr (R-KY) urged the Biden administration to utilize the Presidential Drawdown Authority, an U.S. foreign policy tool for “crisis situations,” to ensure “speedy delivery of defense articles and services” related to Taiwan. Meanwhile, Reps. Brad Sherman (D-CA) and Rich McCormick (R-GA) addressed the potential for integrating Taiwan into the AUKUS Pillar 2 framework for emerging technological cooperation. Likely due to the inclusion of several Taiwan-related provisions in the National Defense Authorization Act for Fiscal Year 2024, which became law on December 22, 2023, U.S. lawmakers did not propose any bills with notable relevance to U.S. security and arms sales support for Taiwan in the first four months of 2024.

The 118th Congress steadily followed its systemic and structural approach to China in the first four months of 2024. American lawmakers’ focus on the strategic competition with China has completely moved away from ideological differences and instead towards more carefully tailored areas that, though not headline worthy, could fundamentally reshape the bilateral relationship.

That being said, the 118th Congress, after a full-year of hard work producing legislations such as the Inflation Reduction Act, seems to lose a bit of the motivation to actively seek changes. That reflects on the general tone of the legislation during this past quarter. The background color of the congressional approach to China is still the passive concept of “decoupling” as opposed to the active pursuit for “derisking.” While “decoupling”—an obsolete soundbite term—was no longer frequently mentioned, it has been firmly branded on every piece of U.S. legislation that seeks to restructure the U.S.-China ties in various areas. The irony is, however, that the U.S. Congress was unsuccessful in producing sufficient legislations that build up U.S. strength to compete with China, particularly in the trade, technology, and energy sectors.

While manufacturing industries appear to be the top concerns of lawmakers, the 118th Congress prefers to focus on stopping China’s expansion and growth in said areas instead of pushing for a groundbreaking renaissance of American manufacturing. The sad reality is that with the government debt concerns and partisan agenda for different fiscal and tax priorities, even with a China competition consensus, the 118th Congress could not agree on a right way to channel funds to the most needed areas in the United States.

Such decoupling-branded doctrine is most significant in this quarter’s push for tech and capital decoupling with China. While some legislations actively seek to compete for standard-setting, most of the lawmakers appear to be more interested in “control” as opposed to “growth.”

That same passive attitude also appeared on Taiwan-related bills. While lawmakers continue to demonstrate their support, or “reaffirm” support for Taiwan, the approach has been superficial. Neither of the bills touched on the core questions that bother U.S. and China at this moment: What does America’s One-China policy entail? And should Washington stick to its strategic ambiguity?

As the 118th Congress prepares itself for an election within six months, there will be electoral pressure that forces lawmakers to put out eye-catchy gimmicks. With many of the areas being branded in the color of decoupling, how much further can the lawmakers “play tough on China” while maintaining the balance with sane policy discussion is worth watching over in the next few months.

The Institute for China-America Studies is an independent nonprofit, nonpartisan research organization dedicated to strengthening the understanding of U.S.-China relations through expert analysis and practical policy solutions.

1919 M St. NW Suite 310,

Washington, DC 20036

icas@chinaus-icas.org

(202) 968-0595

© 2026 INSTITUTE FOR CHINA-AMERICA STUDIES. ALL RIGHTS RESERVED.

What global firms should take note of after U.S. Supreme Court’s ruling on Trump’s tariffs